Seeking a ‘margin of safety’ (but not as you know it)

If the father of value investing, Ben Graham, were alive and investing in value stocks today, what factors would he use to calculate a company’s ‘intrinsic value’? What intrinsic value should we award to companies that contribute to one in five deaths worldwide?

“The three most important words in investing are margin of safety”. So said Warren Buffet.

Value investors tend not to like the Artemis Positive Future fund. Their implicit criticism seems to be that there is no ‘margin of safety’ in the stocks we invest in. How valid is that?

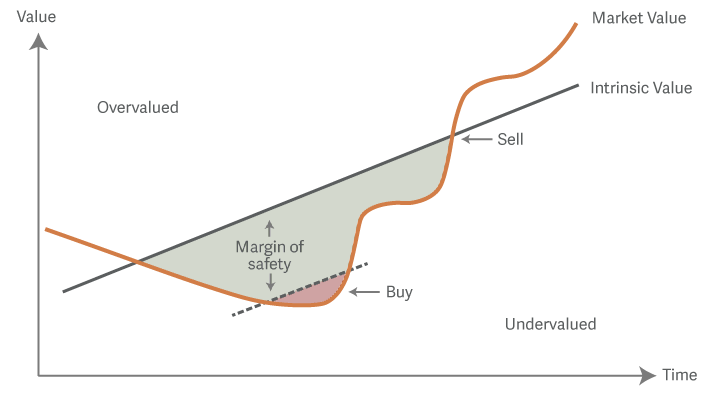

Margin of safety (opens in a new window) is a principle of investing whereby a canny investor only purchases companies when their price is significantly below their intrinsic value. It was popularised by Benjamin Graham, the British-born American economist and professor widely considered as the father of value investing, and, more recently, by Warren Buffet.

Margin of safety in action

What is the ‘margin of safety’ today?

Graham would repeatedly tear up the rule book of value investing – and then re-write it. He would rebuild his methodology for calculating the intrinsic value of a company and revise his calculations of the discount needed to make the margin of safety attractive.

If Ben Graham were alive and investing in stocks today, what factors he would use to model a company’s intrinsic value? And how he would formulate a ‘margin of safety’ in industries that are increasingly being recognised by society, politicians and investors as being environmental or socially ruinous?

Might identifying a ‘margin of safety’ in the 2020s mean something slightly different than it did in the 1930s and 1940s? Might the loss-averse Mr Graham have changed his calculations to take into account factors such as the impact a company has on society or the environment – particularly the negative ones?

I think that he might.

What intrinsic value can you ascribe to a fossil-fuel company?

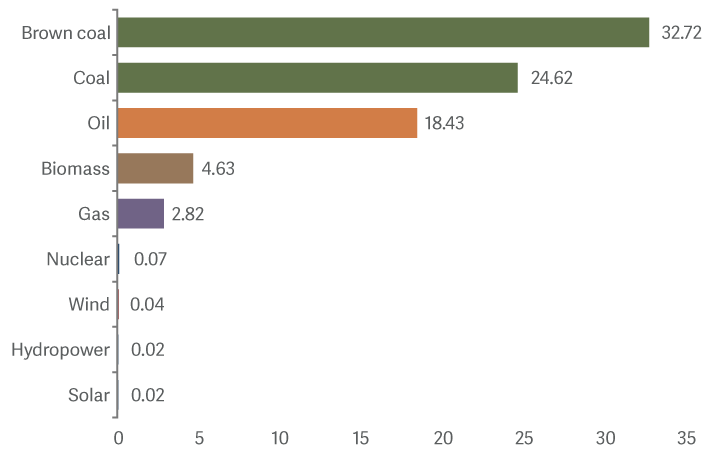

Many fund managers and investment bankers in the world today are busily trying to decide what oil reserves are worth and thus how much to pay for shares of oil companies. At the same time, research shows one in five deaths everyday are caused by the burning fossil fuels (opens in a new window).

Should deaths per terawatt hour be incorporated into the valuations of energy companies?

Death rates from energy production per TWh

What intrinsic value should we award to companies that contribute to one in five deaths worldwide? How might governments start to tax those companies and disincentivise their activities? How quickly might the world decarbonise? And what would the appropriate margin of safety be if carbon taxes suddenly increase to price-in some of the externalities these businesses are currently imposing?

After all, there is clearly negative value for the estimated eight million people who die each year from fossil-fuel pollution (a number roughly equivalent to the population of New York City).

What if cost-pressured healthcare systems look for better, cheaper ways to manage diabetes?

Margin of safety isn’t just something for investors in oil majors to worry about. What margin of safety is attractive for a company that keeps jacking up prices for insulin while providing little in the way of a better product or better outcome for diabetic patients?

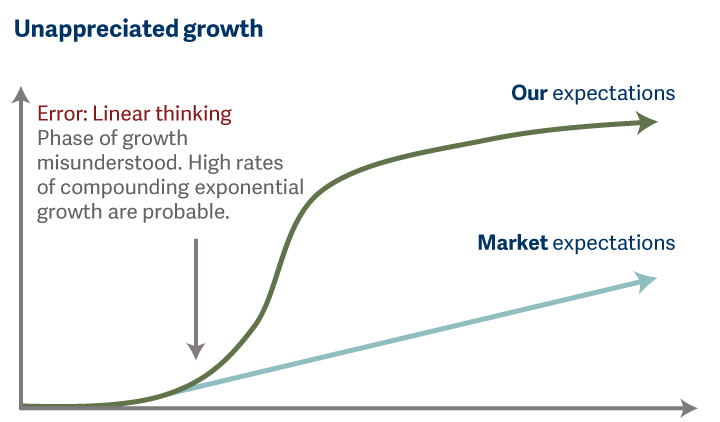

Some investors mistakenly look at our fund through the lens of traditional valuation metrics

These metrics are often backward-looking or focus on earnings expectations for the next 12 or 24 months. If investors choose to look at our fund in that way, then it is understandable that they struggle to understand why we invest in companies that look so expensive.

The point is this: we invest in innovators who are trying to help the world reimagine the way we live and to transform the way we do things in the future. What is the fair price to pay to day for technologies that solve problems like climate change? What should we pay for exponential earnings growth?

Margin of safety means something different today than it did in 1940

We look for companies that are built with a philosophy of innovation and doing things better.

They include:

- MIPS, whose helmet technology reduces rotational brain damage when someone falls off their bike

- Tesla and Alfen, which is helping the world’s transportation systems move away from the internal combustion engine

- Montrose Environmental, which is helping companies to plan their journey to being more environmentally responsible

In every case, we invest in these companies safe in the knowledge that the markets they operate in are helping change the world for the better – and that their earnings have the potential to be exponentially larger in the future.

We are investing in future value

This can seem scary. And we freely admit that the share prices of the companies we invest in can be volatile. Because we look for companies that will both help to create and then prosper in a more positive future, it inevitably means we have less proof that they have been successful in the past. So traditional valuation metrics may make our portfolio look expensive in the here and now.

Because we look for exponential growth, our expectations often differ from the market – and traditional valuation metrics make our portfolio look expensive in the short term

But while they may look expensive today, we have high confidence in the intrinsic value of our companies. We think ‘margin of safety’ today increasingly means having a product, idea or service that can help to solve one of the many sustainability challenges the world is beginning to confront.

Clearly, not all of the companies we invest in will be successful at disrupting the status quo. The important point is this, however: the world seems to be recognising how much needs to change in the coming years and we believe that companies that we invest in have the technology to make that change a reality.

So, I look forward to a future of investing with a ‘margin of safety’ – but not as you might know it.