Artemis UK Smaller Companies Fund update

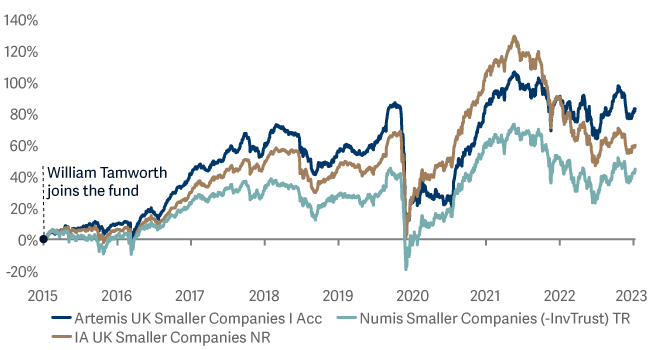

Mark Niznik and William Tamworth, managers of the Artemis UK Smaller Companies Fund, report on the fund over the quarter to 31 March 2023 and their views on the outlook.

- The fund lagged the index but outperformed its peers.

- Growth companies are currently disappointing the market; we suspect this may continue.

- Unsustainable business models are being exposed by higher financing costs.

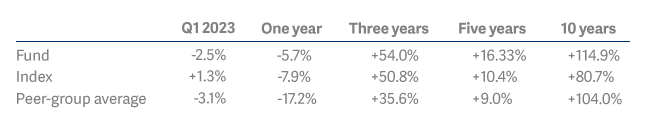

The fund fell by 2.5% over the quarter*

Our benchmark, the Numis Smaller Companies (ex-IT) index, delivered a return of 1.3%. The average fund in our peer group, however, fell by 3.1%.

The biggest headwinds to our relative returns in the short-term came from our holdings in:

- NCC (profit warning – US tech customers retrenching);

- Kin & Carta (profit warning – lower new business wins and weaker spending from non-enterprise customers);

- RWS (no ‘news’ but perhaps a casualty of broader fears surrounding the US technology sector);

- EMIS (the Competition and Markets Authority will subject United Health’s takeover bid to a ‘phase 2’ investigation).

Despite these negatives, the vast majority of our holdings continued to report that trading remains robust. The biggest positives came from MoneySupermarket and Jet2 (strong recovery in demand against a weaker competitive backdrop). More importantly, while the fund lagged the index over the short term, it remains ahead of both the market and its peers over the longer term.

The fund's long-term performance record: a validation of our active approach

We are not in a hurry to shift away from our value bias

That the fund underperformed over the quarter was, in part, because we saw an uptick in profit warnings. Interestingly, this was mainly from newer and faster-growing holdings such as Kin & Carta. It is often ‘growth’ companies who are currently disappointing the market. This could well be a function of high expectations…

It is, after all, possible to justify almost any valuation if one assumes a sufficiently high long-term growth rate. A recent academic study of historic returns in the US stockmarket – Long-Term Earnings Forecasts, Managerial Distortion, and Stock Returns – found that stocks with the highest long-term growth assumptions actually delivered the worst future returns:

“unconditionally, high growth firms are more likely to reduce their growth and low growth ones to increase their growth.”

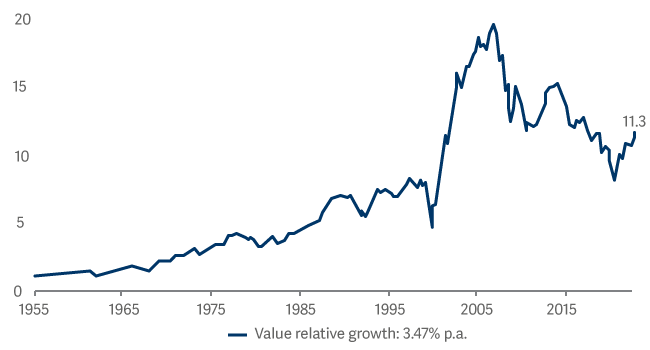

We believe a similar dynamic helps to explain the enormous long-term outperformance of value over growth in the UK smaller companies market.

Cumulative performance of value vs growth stocks within NSCI XIC, 1955-2022

Hype develops around a company that has been growing strongly, unrealistic expectations then form which (on average) the company then fails to live up to. Wary of this trap, we continue to seek out:

- niche market leaders; with

- strong balance sheets;

- good cash generation; and

- reasonable valuations.

On a related note, we should be wary of assuming that the same stocks that led the market higher in the last market cycle will lead it higher this time around: a change of leadership is normal after a bear market.

Bid activity continues

During the quarter, Curtis Banks announced that it had agreed to a cash takeover bid at a 32% premium from Nucleus. This was the 22nd recommended offer we have received for our holdings in the past four years. The average premium on those offers has been 50%. We see bids like this as third-party validation of the value we see across our portfolio. Moreover, with flows into UK equity funds remaining negative (for now), M&A activity continues to represent the marginal buyer in the market.

NCC was our biggest negative; we added to our holding

Weak orders from US tech customers drove a 40% reduction in NCC’s earnings forecast. In the short term, its costs are relatively fixed – so any shortfall in revenues drops through to the bottom line. As a result, its share price fell by 48% on the quarter.

Yet despite the elevated high short-term uncertainty (another downgrade seems likely) we have added to our holding. Why?

- We see the software escrow business (which has proven to be resilient so far) as underpinning the entire market cap of the business today.

- Its balance sheet is robust.

- It should be possible for NCC to reduce costs within its cybersecurity consulting division to match lower expected revenues, so driving a recovery in margins.

EMIS – bid uncertainty

In June 2022, EMIS Group recommended a cash offer from United Health at a 49% premium. On 31 March, the Competition and Markets Authority announced it had not accepted the remedies proposed by United Health and would therefore refer the acquisition to a ‘Phase 2’ investigation.

In response, the shares fell to 32% below the bid price albeit still 11% above the price before the bid was first announced. After the quarter end EMIS subsequently confirmed that it and the bidder would proceed with the Phase 2 CMA investigation (rather than terminating the merger) with the long stop date extended by a further year. This has led to a partial recovery so far in April.

We bought a new holding in Tatton Asset Management…

We initiated a new holding in Tatton Asset Management. We first met the company ahead of its IPO in 2017. It has (more than) achieved its initial targets since then. We are attracted by the structural growth in platform-only discretionary fund management. We have seen similar dynamics unfolding at Brooks Macdonald (an existing holding) and at Brewin Dolphin (one of our former holdings).

The company is currently adding over £100 million of new client assets every month to a base of around £12 billion assets that are already on its platform. This growth, when combined with the high return on capital model, drives strong cashflows.

Unlike some of its competitors, Tatton does not have a back book of historic business on higher fees to defend. It can therefore offer a compelling, low-cost offering. Any new business it wins comes with minimal additional costs which, in turn, drives high incremental margins. The shares are trading on a free cashflow yield of 5%. We feel this is attractive given the scope for many years of strong growth.

…and FDM

We started a new holding in FDM, a recruitment consultant. It has a strong balance sheet and an excellent long-term growth record (we had owned the shares previously but sold out when we felt the valuation had become too stretched). Its high return-on-capital model leads to strong cash generation as the business grows.

We sold RPS, Crestchic and Euromoney after takeover bids completed

We sold out of RPS as the Tetra Tech’s takeover (at a 90% premium to the pre-bid price) completed.

Similarly, we sold our holding in Crestchic after the bid from Aggreko completed (44% premium) and Euromoney after a private equity bid completed (34% premium).

Outlook: unsustainable business models are being exposed by higher financing costs

There has been a huge amount of commentary on the unravelling of Silicon Valley Bank and the turmoil in the banking market. We will not rehearse those discussions here. We would make four observations where we feel there may be ‘read across’ from the crisis to some of the companies in our portfolio.

- Credit is likely to be tighter than it has been in the recent past. With higher interest rates, we expect business failures to be a greater feature of this cycle than the last. Businesses that are not profitable are under greater scrutiny and funding is not available for those with business models that are deemed to be unsustainable.

- This should benefit market-leading companies with strong balance sheets. Nine of the top 10 holdings in our fund are leaders in their respective markets. Meanwhile, the median forecast net debt-to-Ebitda for the fund is just 0.2x.

- Companies may choose to refocus on their core businesses. Might this, for example, dilute the threat to MoneySupermarket from Amazon’s move into the insurance price comparison market?

- Tighter credit conditions should increase the advantage of incumbency (when compared to either disrupters or challengers). We expect less competition from lossmaking competitors for some of our holdings, such as GB Group, Gamma Communications, Lookers and Telecom Plus.

* Source: Lipper Limited/Artemis from 31 December to 31 March 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: Numis Smaller Companies (-InvTrust) TR; A widely-used indicator of the performance of the UK smaller companies stockmarket, in which the fund invests. IA UK Smaller Companies NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ’comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.