Artemis Positive Future Fund update

The managers of the Artemis Positive Future Fund report on the fund over the quarter to 30 September 2023 and their views on the outlook.

Review of the quarter to 30 September 2023

A combination of thematic, sector and stock-specific headwinds saw the fund (down 7.6%) underperforming the MSCI AC World Index (up 0.6%) and its global equity peer group (down 0.9%) over the quarter. The main contributing factors were:

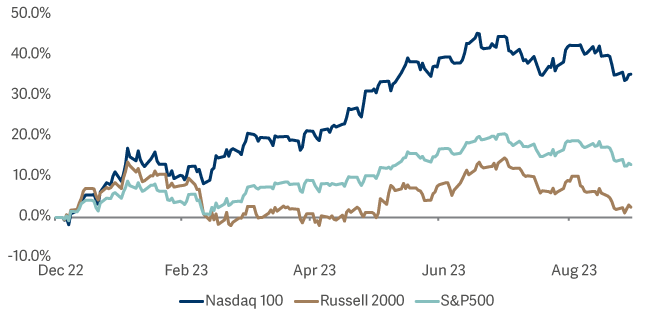

1) Small and mid-caps materially underperformed large caps once again.

2) High interest rates and bond yields were negative for our emerging growth stocks.

3) Two of our long-term positive-impact themes – clean technology and healthcare technology – meaningfully underperformed the wider market.

The de-rating of clean technology stocks was a response to the (short-term) over-supply of solar panels and electric vehicle chargers (following tightness in supply chains seen in 2022 and weaker residential construction).

Meanwhile, producers of diabetes management technologies (including two of our holdings: Insulet and Dexcom) were negatively impacted by fears that GLP-1 treatments (so-called ‘skinny jabs’) would reduce the incidence of diabetes and so lower demand for their products.

4) Planet Fitness saw the surprise exit of its longstanding chief executive, prompting the share price to fall by 24% on the quarter. We sold the holding.

Activity

The portfolio has been increasingly tilted away from ‘emerging growth’ and towards ‘established growth’ names: our weighting to the latter group of stocks has risen to approximately 80%. Some of this increase has been passive (a function of stock performance) and some has been a result of decisions we have taken on a stock level.

We added four new positions to the fund during the quarter:

Ameresco – US-listed Ameresco is a clean-tech integrator and a developer of renewable energy assets. It works in partnership with a range of clients – including public-sector organisations – to develop energy-saving projects, to perform energy 'retrofits' and increase the use of renewables. It has a strong pipeline and trades on what we regard as an attractive valuation.

Shimano –Bike sales enjoyed a boom during the pandemic – then suffered a sharp slowdown as normality slowly returned. With the industry now beginning to stabilise, we can buy into a company whose products (bike components such as brakes and gears) promote and enable exercise, a ‘miracle cure’ for a range of health issues.

Coursera – This is a high-quality growth business in the education technology space with good operational momentum trading on what we regard as an attractive valuation.

Carrier Global – this manufacturer of heating, ventilation and air conditioning (HVAC) systems recently acquired Viessman Climate Solutions, a division of a family-owned German business. Buying Viessman and selling a number of non-core business divisions has positioned Carrier as a simpler business focused on intelligent climate and energy solutions. The acquisition improves its growth profile and also provides opportunities for margin enhancement.

We reduced Insulet & Dexcom – Extremely negative sentiment about the potential impact of GLP-1 drugs on demand for diabetes-management technologies triggered a pragmatic reduction in the size of our holdings in these two businesses. We will add back to these positions if sentiment remains weak (or gets weaker) and valuations become more compelling.

We sold DiaSorin and Everbridge – Our conviction in the growth of DiaSorin’s end markets (diagnostic reagents) over the next 12 months has faded. Meanwhile, our thesis for investing in mass-notification specialist Everbridge is broken. It could become an acquisition target but given increasingly competitive end markets, we can find better opportunities elsewhere.

Positive impact – three updates from our companies

Oxford Instruments – The scientific research equipment manufacturer published its 2023 Sustainability Report. It is making good progress in reducing its operational emissions and increasing diversity. It is engaging with its supply chain in a bid to reduce its upstream emissions. The company has bought forward its net zero target to 2045, bringing it more closely into line with its UK peers. It has also set emission-reduction targets and measures of progress will be formally submitted to the Science Based Targets initiative (SBTi).

Tetra Tech – This US-listed environmental engineer focuses on clean water and sustainable infrastructure. It sees a favorable environment from the passing of the US infrastructure Investment & Jobs Act (IIJA) and, further out, the Inflation Reduction Act (IRA). During the quarter, the company provided further detail about ‘Delta’ a suite of tools it has developed to increase efficiency and accuracy by applying autonomous monitoring, AI and predictive environmental analysis. These proprietary technology tools increase the efficiency of Tetra Tech’s own operations; it is also selling them to other users on a subscription basis.

First Solar – This US-listed, thin-film solar PV manufacturer aims to be a world leader in ‘responsible solar’. This means targeting the lowest environmental footprint in the industry (thin-film solar has a 2.5x lower carbon footprint and 3x lower water footprint than traditional polysilicon) but it also means it has zero tolerance for forced labour. Like most other industries, clean tech faces human-rights challenges in its offshore supply chain. First Solar’s thin-film manufacturing means that it doesn’t have exposure to the well documented human-rights violations associated with more traditional polysilicon manufacture in China’s Xinjiang region, which is responsible for c91% of global polysilicon supply. But it still faces challenges. During the quarter, First Solar revealed that an audit had revealed bonded foreign migrant labour was being employed at four of its service providers in Malaysia. That First Solar has been so transparent regarding the problems it has experienced should be applauded.

Outlook

Whilst the recent environment has been unfavourable for our strategy, a number of long-term signals mean we are positive on our positioning and excited about the opportunity to generate returns for our investors.

1. Relative outperformance by large caps – and particularly by mega-caps – appears to be unsustainable. Relative valuations of small-to-mid caps and of growth stocks are close to historic lows.

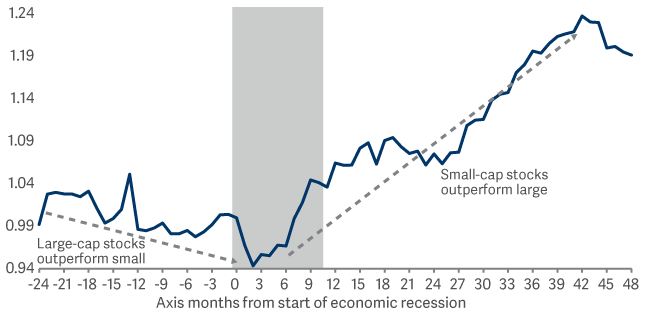

2. Small-to-mid-caps tend to outperform in the early stages of an economic downturn.

Relative performance of Russell 2000 vs S&P 500 index around recessions

3. The US is seeing a surge in spending on facilities to make clean technologies. The US Inflation Reduction Act (IRA) represents the single largest investment in clean energy in US history. The first assessments of the impact on US construction spending of the IRA, the Infrastructure Investment and Jobs Act (IIJA) and the Chips Act, which each provide direct funding and tax incentives for private and public manufacturing construction (largely clean technologies), have recently been published. The deliberately supportive policy environment for manufacturing construction has created a surge in construction spending for manufacturing facilities.

Source: Lipper Limited/Artemis from 31 March to 30 September 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: MSCI AC World NR. IA Global NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ‘comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.