US equities – Where next?

While US equity markets have continued to perform well, risks associated with prolonged inflation and economic slowdown remain. Cormac Weldon explains the areas where he is finding opportunities, ranging from new housing to AI.

Cormac Weldon, manager of the Artemis US Select and Artemis US Smaller Companies funds, talks about his view on the higher-interest rate environment and how he is positioning his funds as a result of it.

Recession avoided?

We have a relatively sanguine view on the US economy at the moment. Despite many negative predictions, recession has been avoided so far. We think this is mainly due to the excess savings accumulated during Covid. There are now concerns about those savings levels being eroded: US consumers are continuing to spend, with personal spending increasing 0.8% in July1. Higher-earning consumers, who came out of the pandemic with very high levels of savings, remain buoyant. Where there is a squeeze is among lower-earning consumers, who had lower levels of savings.

Inflation abating

Inflation has stayed higher for longer than we anticipated, primarily because of wage inflation.

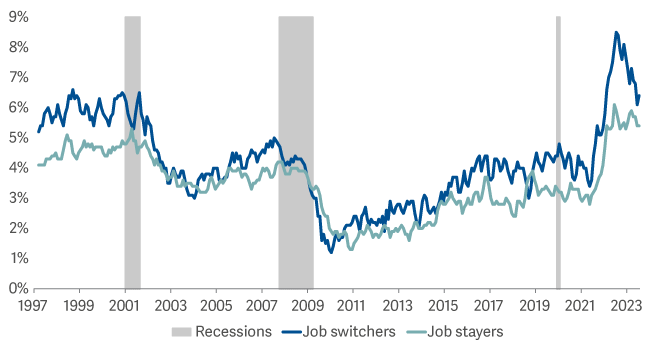

Chart 1: Wage inflation rolling over

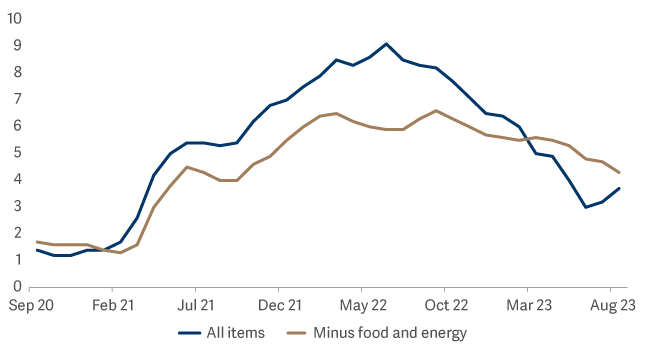

Wage inflation has been kept elevated, primarily because of people switching jobs to secure higher earnings (Chart 1). The trend seems to have run its course and as a result wage inflation is rolling over. Although headline CPI remains volatile, core CPI is trending down (Chart 2).

Chart 2: US CPI inflation

In addition, productivity growth has been better then expected. It rebounded strongly in the second quarter of this year, increasing by 3.5%2.

Against this backdrop, we expect the Fed to maintain interest rates at current levels and don’t expect them to be reduced in the short term, although clearly this depends on the trajectory of inflation.

Rather than let the view of whether there will be a recession or not dominate our stockpicking, we think it's more informative to analyse the individual drivers of the stocks available to us by looking for those with an attractive combination of catalysts and attractive valuations.

Some examples of areas where we are finding opportunities:

New build homes

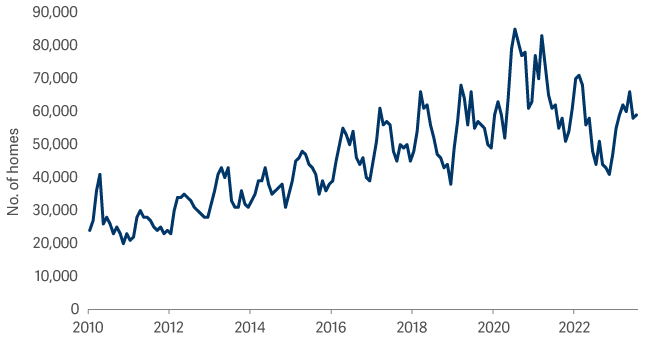

A major contributor to the inflationary backdrop has been higher housing costs. Rising interest rates might have been expected to bring the housing market to a standstill, but in fact have led to some interesting new dynamics. Going into the higher rate environment, there was already a shortage of capacity in the housing market, particularly in ‘starter homes’. Higher mortgage rates have meant that people with mortgaged homes are unwilling to trade up, so there is not much supply of ‘second hand’ housing stock. As a result, demand for housing, particularly for first-time buyers, is being met by new builds (Chart 3). House builders have adjusted to the new environment by offering smaller cheaper homes and often incentives for first-time buyers.

Rather than invest directly in house builders, we have chosen to access this theme through building material stocks. These have included Builders FirstSource, the US’ largest supplier of building products, prefabricated components and associated services, with a presence in about 40 states and TopBuild, a leading supplier and installer of insulation products. We also invest in Eagle Materials, which is predominantly a cement producer (and so plays into the broader theme of infrastructure investment) but supplies plasterboard to housebuilders.

Chart 3: Sales of new single-family homes

Selected opportunities in utilities

We have an overweight position in the utilities sector in US Select, concentrated in a couple of stock-specific ideas, namely Constellation Energy and PG&E.

Constellation Energy consists of the nuclear power assets formerly owned by Exelon, from which it was spun out in 2021. The 2022 Inflation Reduction Act (IRA), with its emphasis on clean energy and climate change, offers very significant subsidies to nuclear power companies and has transformed Constellation’s growth profile. In addition, the Big Tech companies are continuing to build data centres that are very power consumptive, and this building programme will be accelerated by the take-up of AI. Microsoft and Google, amongst others, have pledged to be net zero by 2030 and so will need significant supplies of carbon free energy. Constellation should be a major beneficiary of this.

PG&E will also benefit from some of the incentives for clean-energy producers in the IRA. Under the guidance of its new, highly impressive management team, this Californian utility company has transformed itself. Where it once had a poor fire-safety record, the California Public Utilities Commission estimates that the extensive investments made by the new management team have reduced the possibility of wildfires by 90%. It is now becoming a trusted partner in developing the production of renewable and carbon-free energy.

The company’s much improved relationship with politicians was reflected in two pieces of legislation passed in California last year. The first is a bill approving the company’s plan to put approximately 10,000 miles electricity-transmission cables in areas at high risk of wildfire underground. Second, the state has performed an about-turn with regards to the company’s Diablo Canyon nuclear facility. It had been scheduled to be decommissioned within the next two years, but the California legislature voted to extend its life.

And areas we are avoiding…

Underweight financials

In general a rising interest rate environment would tend to favour banks. But our funds are underweight financials in general and hold no banks. Despite the benefit of higher interest rates, we believe the banking sector is facing too much uncertainty at the moment. There are regulatory pressures, and the Biden administration does not seem supportive of big banks in particular.

Instead, we prefer to hold specialist financials such as Moody’s (which benefit from growth in debt markets) and Blackstone (private equity).