Small-cap catalyst? You’re asking the wrong question

An obsession with what is going to increase earnings or bump up the share price in the short term drastically reduces the investable universe of UK smaller companies and potentially overlooks the main drivers of long-term returns, according to Mark Niznik and William Tamworth.

In the past few years of lacklustre returns for UK small caps, we have regularly been asked what the eventual catalyst for outperformance will be. We shouldn’t have been surprised. This is what many investors ask when analysing individual smaller companies. In both cases, we think they are asking the wrong question.

An obsession with what is going to increase earnings or bump up the share price in the short term drastically reduces the investable universe and potentially overlooks the main drivers of long-term returns.

These include M&A (32 of our holdings have been taken private in the past five years at an average premium of 50%), record numbers of buybacks (more than a dozen of our holdings have bought back shares in 2024) and reinvesting free cashflow to benefit from compounding growth.

Growth doesn’t work in small caps

There is another problem. Pinning your hopes on a catalyst means pinning your hopes on the growth style of investing, which is often associated with the small-cap market.

It isn’t difficult to see why. In the same way that rock stars will attract an entourage of hangers on, small-cap growth stocks on a rapid ascent will attract investors hoping for a type of success by association.

Unfortunately, the comparison with rock stars doesn’t end there. Although there is practically zero correlation between forecast and historic earnings growth in small caps1, expectations get elevated until they become impossible to live up to. As a result, their spectacular rise to the top is often matched by the subsequent implosion.

Data from Deutsche Numis shows that the small-cap premium – the amount by which smaller companies in aggregate have beaten larger ones over the long term – is 3.1% per annum. But if you break down the smaller companies market into value and growth, you find the former has outperformed the latter by 3.7% per annum2. This means investing in a growth strategy cancels out a significant proportion of the small-cap effect.

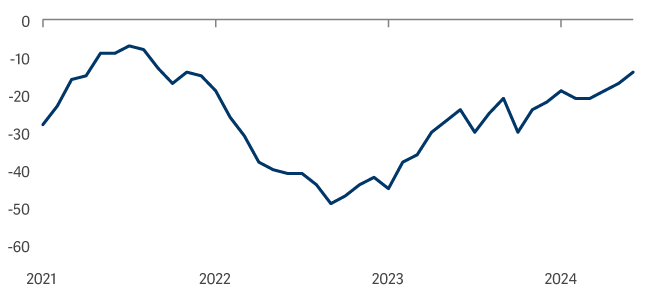

Cumulative performance of value relative to growth within DNSCI XIC

3 year performance percentile versus style

Despite this, the vast majority of small-cap funds are overweight growth, with only a handful either tilted towards value or balanced somewhere between the two.

Our valuation bias doesn’t mean we are avoiding ‘growth’ – our portfolio’s EPS (earnings per share) is rising at 10% a year3. It’s just that at a P/E of 13x3, a free cashflow yield of 7% and no net debt4, we are refusing to overpay for it.

Do small caps need a catalyst for growth?

And what of the UK small-cap market as a whole? How can it possibly hope to outperform without a catalyst?

Well, when people talk about a catalyst, do they mean falling interest rates?5 Rising consumer confidence?5 Above-inflation pay rises?6 All of these are coming through, yet the more domestically focused small-cap end of the market remains on a discount to the larger end, which itself remains on a discount to the rest of the world.

UK consumer confidence is recovering

Perhaps most important is political stability, which allows companies to plan for the future.

Following the Budget, there was a sense of uncertainty around how increases to national insurance and the minimum wage would affect businesses.

Our preference for market leaders means most companies in our portfolio should be able to pass these additional costs on to customers. Take a holding such as J D Wetherspoon, which you might imagine would be one of the worst affected: the discount on what it charges for drinks has grown wider compared with other high street pubs over the past couple of years, giving it room for manoeuvre.

Not just visible in hindsight

The policy changes announced in the Budget are likely to have a modest inflationary impact. This cements our view that although interest rates are on the way down, they will not return to the near-zero level of the 2010s when ‘growth at any price’ emerged as a (paradoxical) investment mantra.

If this is the catalyst you were waiting for, you are likely to be disappointed. But the same could be said if you are waiting for any type of catalyst in UK small caps. Outperformance in individual stocks in this area is driven by buying solid companies for a price that underestimates their growth and profitability, then giving them the time for fundamentals to assert themselves.

Unlike so-called catalysts, these metrics aren’t only visible with the benefit of hindsight. Fail to grasp this concept and you risk viewing the sector’s long-awaited comeback in the rear-view mirror.

2Source: Deutsche Numis as at 31 December 2023.

3Artemis, Bloomberg as at 30 September 2024.

42025 weighted median.

5Lazarus as at 30 September 2024.

6Asda as at 31 August 2024.