Bond duration: Short can be sweet

In the QE era, adding duration to your bond portfolio – and holding onto it – was an effective investment strategy. But as Liam O’Donnell explains, economic and market conditions have changed – and there are better ways to profit from the opportunities today’s bond market offers.

If you believe – as we do – that interest rates are going to keep heading lower, then your recent conversations about bonds have probably touched on the question of duration. How much interest-rate risk should you be taking in your bond portfolio? With rates moving lower – albeit it at an uneven and unpredictable rate – adding a significant slug of duration to your bond portfolio might seem like a good idea. But can you go too far? Can you have too much of a good thing?

I believe you can. To be clear, we are positive on the outlook for bonds of almost every type: interest rates and bond yields are moving lower. At the same time, however, these are not the conditions in which investors should feel obliged to go ‘all in’ on duration to generate returns. There is another way…

1. The balance between risk and reward in short-duration bonds is compelling

Firstly, yields on offer across the investment-grade universe are attractive. Bond yields tracked interest rates higher as central banks fought to restore price stability. Now central banks are moving the other way, cutting interest rates as inflation moderates in order to secure a soft landing for the economy. This is positive for bonds in general but, because the yield curve is currently flat, you simply don’t need to take outsized risks on duration to derive handsome total returns from your fixed-income allocation.

Yields across the sterling investment-grade market are high

That investors can achieve the same level of yield at the front end of the curve at a time when central banks are cutting rates represents a compelling tactical opportunity. The latest round of central bank meetings, which saw the US Federal Reserve cutting rates by 50bps in September, has shifted the balance of risks heavily in favour of shorter-dated bonds. From here, in my view, any high-quality asset yielding more than 4% with up to five years to maturity is currently a ‘buy’.

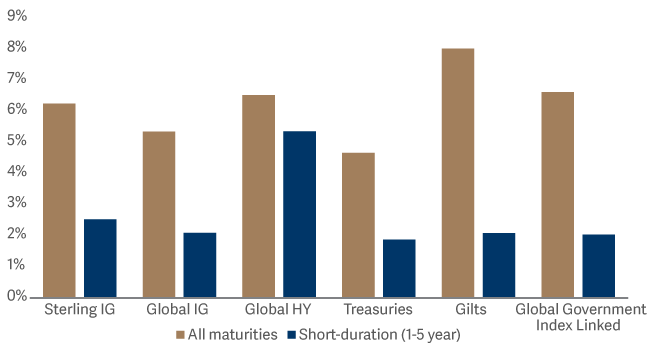

At just over 5%, yields on sterling, short-dated investment-grade bonds (one of the core markets in which the Artemis Short-Duration Strategic Bond Fund hunts for returns) are compelling given the low levels of risk you’re taking. The chart below shows how volatility varies between all maturity indices across the bond universe versus their shorter-maturity counterparts. The message is clear. Shorter maturity bonds are less risky. Putting this together with the current shape of the yield curve reveals a unique opportunity. You’re getting a similar yield to those on longer-dated bonds – but with far less interest-rate risk and lower volatility.

You’re getting a similar yield to those on longer-dated bonds – but with far less interest-rate risk and lower volatility.

Short-dated investment -grade bonds deliver low levels of volatility

(January 2010 to present)

2. Duration is not the be-all and end-all for generating returns

As Artemis’ rates specialist, it’s part of my job to ensure we get our calls on duration right. And, in broad terms, I am positive about duration – but not uncritically so. Investors need to acknowledge that, compared to the pre-pandemic era in which bond markets were sedated by increasingly large doses of QE, the new era for bond markets seems likely to be characterised by:

- Greater uncertainty about inflation.

- Desynchronization (in both economic and monetary policy terms) between different regions of the global economy.

- Political populism, fuelling worries about deficits.

- Quantitative tightening and the retreat of central banks from government bond markets.

The net result seems likely to be higher volatility, particularly towards the long end of the curve. That, in turn, suggests that this is the time to think before placing an all-in bet on duration. These are conditions in which it pays to be active.

The good news is not just that yields on short-duration investment-grade bonds are attractive but there are other ways to enhance returns from your bond allocation beyond reaching on duration, such as:

- Using active asset allocation to add (or subtract) credit risk and cyclicality by buying (or selling) short-dated high-yield bonds. (An asset class for which we are enthusiastic advocates).

- Using detailed analysis to identify the most attractive assets within each pocket of the bond market: government, investment-grade and high-yield. This can dramatically enhance the returns you’ll derive from making the right calls on duration.

- Retaining some inflation protection through an allocation to index-linked bonds.

- Being active in the global rates market, exploiting the instances of relative value that are being created by a desynchronised global rate-cutting cycle and profiting from pockets of relative value within the yield curve.

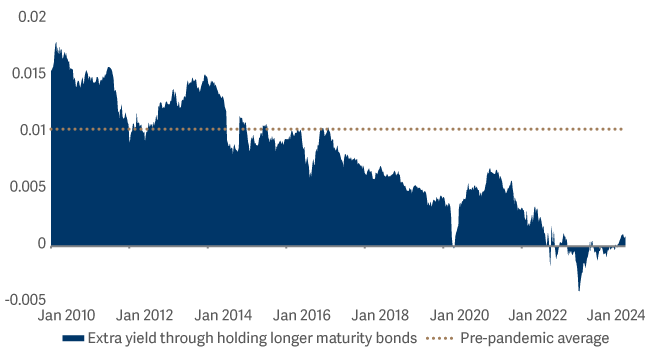

3: The yield curve could steepen, enhancing the tactical case for short-dated bonds

In a rate-cutting cycle, we would expect to see the yield curve getting steeper. That’s particularly the case this time: debt-to-GDP levels worldwide have soared since the last hiking cycle, particularly in the US. Huge volumes of issuance will be needed to fund those deficits. The coming wave of supply would suggest that a degree of caution towards the long end of the curve (which is where you need to hunt if you want to make an aggressive call on duration) might be wise

Longer maturity investment-grade bonds currently offer no extra yield

The Fed’s bold 50 basis-point cut, meanwhile, should add extra fuel to the global steepening narrative. At this point, however, the 2-Year/10-Year yield curve in the US is still incredibly flat when viewed from a historic perspective.

To us, this underlines the unique attractions of short-duration bonds at this juncture: you’re getting a similar level of yield but with far less interest-rate risk and far less volatility. To keep it short and sweet: this is a good time to buy an actively managed, short-duration bond strategy. If you’d like a recommendation, let me know.