How much longer will the UK remain a buyers’ market?

For the first time in a decade, overseas investors are beginning to pay attention to the once unloved UK market. Ed Legget explains why even a modest reallocation of global capital towards the UK could trigger a dramatic re-rating of one of the world’s cheapest stockmarkets.

- UK shares are unsustainably cheap in a global context. Markets will eventually arbitrage away that discount.

- There are signs that perceptions of the UK economy have started to change.

- Even a modest reallocation of capital to the UK by global investors will trigger a swift and significant re-rating.

At Artemis, we’ve spent the past two-to-three years arguing that investors ought to increase their allocation to UK equities. Perhaps that’s inevitable: our business built its reputation hunting profits in the UK, and it remains an area of strength for us today.

In recent months, however, a growing number of market commentators – and some of our peers – have begun to join in the chorus. Our message is a simple one:

- The UK’s listed companies currently trade on an undeservedly wide discount to their peers in every other major global market.

- The US trades on a forward price-to-earnings multiple of 21.6x compared to just 11.7x for the UK. (The Artemis UK Select portfolio, meanwhile, trades on a multiple of just 9x.)1

- The outlook for the UK’s economy is improving just as growth elsewhere appears to be weakening.

- The general election restored a degree of political stability to the UK that has been largely absent since the Brexit vote in 2016.

- While they wait for UK stocks to be-rated, investors are being paid to be patient. Some sectors, such as banks, are currently generating double-digit distribution yields (the cash companies return to their shareholders through share buybacks and dividends).

One question we’re often asked at the moment is why UK shares won’t simply continue to trade on this historically wide discount indefinitely? And – if not – what will cause it to narrow?

We’re already seeing two significant forms of buying unfolding in the UK – share buybacks and M&A. It is, however, a third form of buying – inflows from overseas investors – that we think will prove to be decisive in narrowing the UK discount.

1. Companies are trying to close the ‘UK discount’ by buying back their shares or moving their primary listings to the US.

The managers of UK-listed companies are aware that their shares trade on a wide discount. That narrows a little once we adjust it to reflect the market’ sectoral makeup – but only a little. Depending on the sector you’re looking at, UK companies trade on a 15% to 50% discount to their US peers. Rather than waiting for the market to arbitrage that discount away, they are, increasingly, taking matters into their own hands.

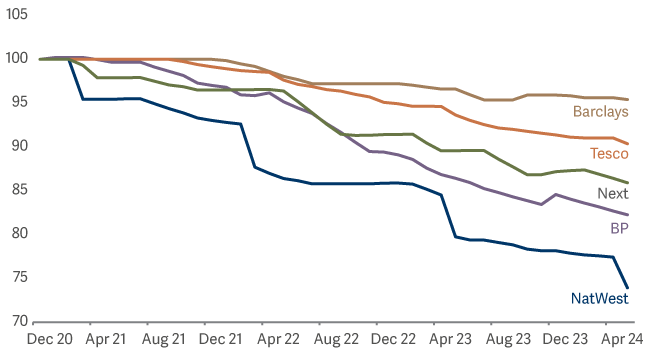

One result is that share buybacks in the UK are running at a c.£40 billion annualised rate, largely focused on the financials and energy sectors. One of Artemis UK Select’s largest holdings, NatWest, has reduced its share count by 30% since 2020. More recently, Vistry and WH Smith have become the latest holdings in our portfolio to announce buybacks.

UK companies are buying back meaningful quantities of their own shares

The other way companies are actively working to close the UK valuation gap is by relisting their shares, often in the US, where they can tap into a bigger pool of liquidity and instantly be awarded significantly higher valuation multiples.

Earlier this year we voted in favour of a proposal by one our holdings, Flutter, to move its primary listing to New York.

Other recent re-listings include:

- CRH

- Indivior

- TUI; and

- Ferguson

More companies are considering joining them. In contrast to tracker funds, we aren’t obliged to sell our holdings the moment they no longer qualify for the FTSE. So, we tend to hang onto them when they relist to benefit from the uplift in their valuation multiples.

Earlier this year we voted in favour of a proposal by one our holdings, Flutter, to move its primary listing to New York.

2. M&A is the second channel through which capital is targeting the UK discount

It is a truism that fund flows tend to follow performance, particularly in an era in which passive investment is increasingly dominant. Up to this point, the combination of rising earnings, double-digit cash returns and modest valuation multiples offered by UK plc, has not been enough to attract fund buyers.

Corporates, however, look at things differently. And, when they run their slide rule across UK listed companies, they see an opportunity to acquire their long-term earnings streams for a song. As a result, we have seen over US$56 billion of deals in the UK market over the year to date2. Combine these deals with buybacks and re-listings and around 6% of the UK’s market cap will be retired this year…

3. Fund flows from overseas will be the decisive factor in closing the UK discount

In the medium term, we believe it will be inflows from overseas investors that will be the crucial factor in closing the UK discount.

Here, the signs have begun to turn positive:

- While flow data has been negative for much of this year, recent readings point towards an inflection: there has been an upturn in flows into the UK market from global institutional investors since the general election3.

- We have seen a similar trend in flows into the Artemis’ UK fund range. From the time I joined Artemis in 2015 until relatively recently, the UK Select strategy attracted little-to-no interest from investors outside the UK. That has now changed; we recently launched a Luxembourg-domiciled version of the strategy to open it up to investors in Europe.

- The latest edition of the Bank of America’s fund manager survey shows global asset allocators looking to move to an ‘overweight’ stance in UK equities for the first time in three years4.

Investor purchases/redemptions of fund shares in percentage of total net assets terms

In the medium term, we believe it will be inflows from overseas investors that will be the crucial factor in closing the UK discount.

All of that suggests that, after nearly a decade on most international investors’ ‘sell’ lists, perceptions of UK equities may be starting to change. When overseas investors return in earnest, the resulting inflows have the potential to deliver a transformative re-rating of UK stocks.

Even a small change in global asset allocation could produce a swift and substantial revaluation of the UK market

Viewed in a global context, the UK is a relative minnow; it now represents less than 4% of the MSCI World Index by market capitalisation. So, if global investors decide to reallocate even a small portion of their capital away from the US (which accounts for 71% of the MSCI World Index5), the scale of the inflows would be huge in relative terms: it’s like trying to squeeze a quart into a pint pot.

Even a modest increase in their allocation to UK shares by global investors could have a profound impact. When they start to move, valuation multiples in the UK could move higher extremely quickly.

The UK discount won’t last forever

Some retailers always seem to be advertising their latest, unmissable SALE. It’s easy to become jaded; there’s little urgency to buy when a ‘special offer’ seems to last forever. Perhaps investors have begun to feel the same way about the UK stockmarket. That, however, might prove to be a costly mistake – the bargains currently on offer in the UK might not last forever.

2Source: DB Numis as at 5 September 2024

3Source: EPFR, Goldman Sachs Global Investment Research

4Source: Bank of America Global Fund Manager Survey September 2024

5Source: MSCI as at 30 September 2024