The new playbook for bonds: three reasons to look at shorter-dated, higher-yielding opportunities

By focusing their fixed-income allocations on bonds with shorter durations and higher yields, multi-asset investors can maximise income while minimizing their exposure to volatility in interest rates.

The bond market has undergone a significant transformation in recent years. Perhaps most obviously, yields have reset higher. For income-focused investors, this marks a pivotal moment. Bonds are reclaiming their role as valuable tools for generating income, a function that had been diminished through many years of ultra-low yields. But this isn’t simply about a return to the old norms that prevailed prior to the financial crisis. Today’s investment landscape is more complex, marked by persistent inflation, uncertainty about interest rates and strained government balance sheets.

These changes in the broader economic environment suggest that multi-asset investors need to rethink their bond strategies. Inflation, which erodes the purchasing power of fixed income, remains stubbornly high in many economies. At the same time, government debt levels have surged, creating additional risks for the most traditional, plain vanilla form of fixed-income investments: long-dated government bonds. Together, these factors call for a more discerning approach to bonds, one that balances the need for income against the realities of today’s political, economic and market risks.

Rethinking bonds for an era of interest-rate uncertainty

To navigate this new environment, we believe the focus should be on optimizing income while mitigating the risks posed by inflation and governments’ growing fiscal vulnerabilities. For two reasons, this means shifting away from traditional areas of the bond market, such as long-dated government bonds.

- First, long-dated bonds are highly sensitive to changes in interest rates and inflation. If rates were to rise, their prices could fall sharply, creating unwanted volatility for investors.

- Second, the income they provide may not sufficiently compensate for that risk of volatility, especially in an era of uncertainty over inflation, political populism and unpredictable rate movements.

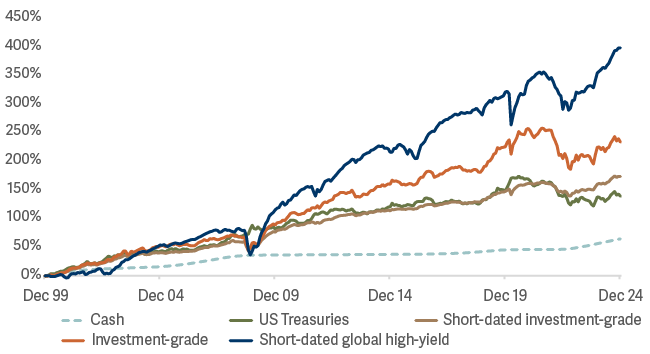

Short-dated high-yield bonds have generated superior returns over the last two decades

So we suggest multi-asset investors shift their spotlight onto shorter-dated, higher-yielding opportunities. Shorter-dated bonds offer three main advantages in the current environment:

1. Higher income potential: Some short-dated bonds can provide higher yields than their longer-dated counterparts.

2. Lower volatility: Shorter durations make these bonds less sensitive to fluctuations in interest rates, reducing the risk of significant price swings.

3. Flexibility to reinvest: Shorter maturities mean investors can more quickly reinvest both the principal and income. In a dynamic market, we should not entirely discount the possibility that rates will need to move higher at some point. The steady income stream that short-dated bonds produce gives investors optionality, allowing for the possibility of reinvesting at even higher yields in the future.

Adapting your fixed-income allocation to economic uncertainty

By focusing a significant proportion of their bond allocation on shorter-dated, higher-yielding bonds, investors can better position themselves to weather today’s market uncertainties. This strategy provides an important balance: it allows investors to capitalize on the income opportunities created by higher yields while remaining agile enough to respond to changes in inflation and interest-rate trends.

Ultimately, our takeaway is clear: while the bond market has returned to relevance as a steady source of compound returns, the old playbook simply won’t work in this new environment. By prioritising shorter durations and higher yields, investors can secure reliable income streams while minimising exposure to the risks posed by high inflation and strained government finances. This is a strategy designed not just to survive in today’s economic conditions but to thrive in it.