How a multi-asset portfolio focused on income can deliver long-term growth

A simple multi-asset portfolio focused on dividend-paying equities and high-yield bonds can help investors meet their long-term goals.

After a long bull market in equities, the simple wisdom of Jeremy Siegel’s ‘Stocks for the Long Run’ – that owning equities is the best way to grow your wealth – seems self-evident. At the same time, many investors want an investment strategy that can deliver total returns more smoothly than is possible through a 100% allocation to shares. Traditionally, the simplest way of sheltering your investment portfolio against volatility has been to make a significant allocation to bonds. And while that remains a sound strategy, we would suggest that investors should also consider the role that that income-generating assets such as dividend-paying equities and high-yield bonds can play.

1) Don’t underestimate the importance of dividends to long-term returns

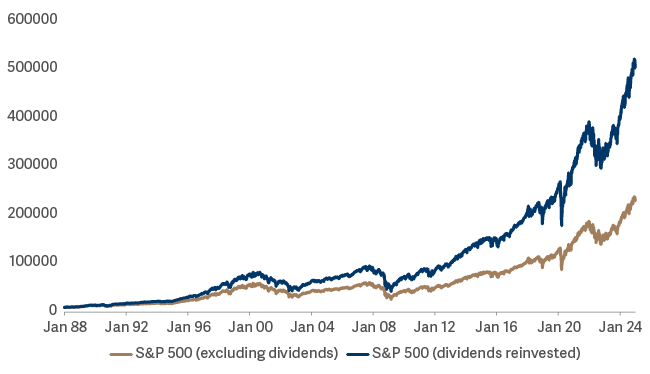

Dividends offer investors two useful things. Perhaps most obviously, they generate an income stream that can grow with inflation. But they also represent a significant proportion of the total return that equity markets have delivered over the long term. That can be easy to overlook, particularly after a decade in which the impressive earnings growth (and multiple expansion) for non-dividend-paying growth stocks has pushed global market indices higher. Look at the S&P 500 index since 1988 and some 55% of the cumulative total return can actually be attributed to reinvested dividends.

Reinvested dividends are an important component of total returns from equities over the long term (growth of $10,000 invested from 1988-2024)

Our perspective is that dividends still have an important role to play in building wealth. It is our experience that it is possible to generate an attractive total return by buying selected dividend-paying equities and then patiently reinvesting the income they pay out, quarter after quarter, year upon year.

2) Owning income-generating assets offers useful protection in down markets

Market history suggests that a simple multi-asset portfolio with its core holdings in corporate bonds and dividend-paying equities provides valuable protection during market sell offs.

Consider a portfolio whose assets are evenly split between investment-grade bonds (ICE BofA Global Broad Market Index) and dividend-paying equities (MSCI World High Dividend Yield Index). Such a portfolio would have imposed far smaller losses on investors during major market corrections than a 100% allocation to equities (MSCI World Index). To take just two prominent examples:

- During the bursting of the dotcom bubble from 2000-’03 – the maximum drawdown suffered by investors in the income-focused portfolio would have been 12%. But by March 2003, investors with a 100% allocation to global equities would have endured a loss of 49%.

- In the short Covid-inspired sell-off in March 2020 – investors in the simple income-based portfolio would have seen an 8% fall in the value of their investments. The losses imposed on equity-only portfolio were, at 15%, almost twice as large1.

3) Short-duration assets can play a part in delivering long-term investment returns

If you own a company’s shares you have a claim on its future cashflows in perpetuity; as a result, equities are inherently ‘long duration’ assets: they are exposed to changes in the discount rate and interest-rate risk. That risk is multiplied if you own growth stocks, the bulk of whose profits are expected to be generated in the distant future.

When interest rates were either low or falling, as they were for much of the decade after the financial crisis, adding duration represented a winning strategy. But what if we have moved into a new era for monetary policy? What if geopolitical tension, trade wars and tariffs mean inflation is stickier and more volatile than it was in the recent past?

Under these conditions, it may be prudent to make a meaningful allocation to relatively ‘short duration’ assets such as high-yield bonds, which are both less sensitive to interest rate expectations and which currently generate an extremely attractive yield.

A simple, income-focused portfolio can harness the power of compounding to grow wealth over the long term

The future is uncertain. Given that, there may be something to be said for steadily gathering and reinvesting dividends from equities and coupon payments from bonds and then letting compounding slowly work its magic. High-yield bonds and dividend-paying equities may, in relative terms, be ‘short duration’ assets. But that doesn’t mean they are only suitable for short-term investors.