The investment themes set to define 2024 and beyond

In his outlook for the year ahead, Artemis’ chief investment officer Paras Anand says that while markets appear to be turning a corner, we are unlikely to return to the environment that followed the Global Financial Crisis.

The big investment themes of 2024

- Energy transition means infrastructure investment needed

- AI requires semiconductor and data centre investment

- High interest rates make life tougher for disruptors

- UK and emerging markets both look promising for 2024

- Expect waves of inflation ahead…

- …and issues to emerge in opaque private equity markets

- A focus on valuation and avoiding stricken vessels will be more important than ever

In the decade or so following the Global Financial Crisis, accommodative interest rates and a strong capital cycle meant all roads effectively led towards Silicon Valley, with disruptive, capital-light and tech-enabled businesses attracting billions of dollars in investment. But the capital cycle ahead looks different.

Here are some of the key themes I believe will shape investor returns in 2024 and beyond.

Public infrastructure

The coming decade will see huge infrastructure spend across the world, with climate change one obvious driver of this trend. If we are to decarbonise the economy, we need to plug into renewable energy, which means not just building new sources of energy generation but transforming the way power is stored and transmitted. We also need to prepare for more extreme weather. The infrastructure of many cities in the developed world is creaking – just consider London’s Victorian drainage and sewage system, which cannot deal with today’s population or the growing number of flash floods.

Other long-term technological issues that need to be addressed include electric car charging stations in terraced streets and building cities to facilitate autonomous driving.

AI infrastructure

Infrastructure spend extends to the world of AI, a technology set to become ubiquitous. But the extent to which its development relies on physical facilities is often underestimated. Billions of dollars will have to be spent on data servers and semiconductor manufacturing. Add to this a geopolitical dimension: for national-security reasons, countries such as the US want to bring chip production ‘onshore’. This will result in a significant capital cycle, creating opportunities for industrial companies and materials providers – as well as shrewd investors.

Resilient economies

This spending should support jobs, wages and the real economy. And, unlike the previous capital cycle, which was largely funded through venture capital and private equity, it will be primarily financed by larger listed companies and governments and will have a broader impact on the real economy.

Focus on valuation

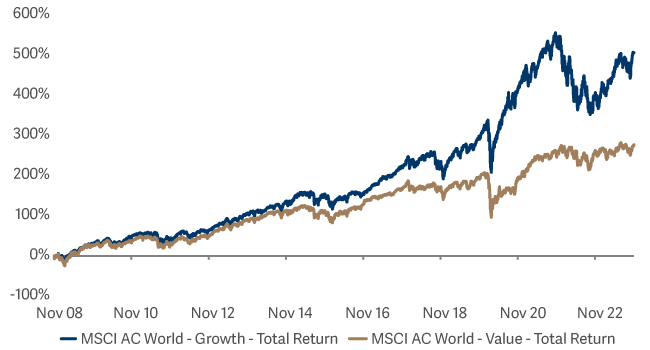

Over the past decade, value has arguably been a poor predictor of future returns. A lack of belief in growth in many parts of the corporate sector and low funding costs meant stocks that were expensive often attracted more investment and became even more expensive. Conversely, areas of the market that were cheap became cheaper. “Cheap” started to become associated with ‘failing’. We saw a large dispersion between richly valued growth stocks and cheaper ‘old economy’ parts of the market. This has every chance of correcting.

Performance of MSCI World Growth index vs MSCI World Value index 28/11/2008 – 30/11/2023

Note: Past performance is not a guide to future returns.

Dancing elephants

Dancing elephants are large incumbent businesses regarded as most under threat from tech disruptors. A feature of the previous cycle was that start-ups priced their goods and services lower than incumbents and often below cost. With the reset in borrowing rates and the start of this new cycle, that phenomenon is largely over.

Companies that successfully managed to hold on to their customer bases can now harness the technology that once threatened them. Just look at how the banks are improving their online proposition, creating apps to help us analyse our spending and – perhaps controversially – reducing the need for expensive branches.

In a few years there will be no division between “old economy” and “new economy” businesses. To thrive, all businesses will need to harness technology. What is exciting about this from an investor’s perspective is that many incumbent businesses are still valued as if they are sleeping elephants.

Areas of opportunity: UK and emerging markets

Two areas could generate strong returns next year. The first is the UK, where share prices have been supressed since 2016. Has the pendulum swung too far? Companies we hold are buying back their own shares at unprecedented rates. Private and overseas buyers are snapping up smaller companies we own at significant premiums. Now could be a rare opportunity for smart investors to buy. A bounce could be sudden.

Looking further afield, I like emerging markets, which account for 50% of global GDP1. They will drive most of the world’s economic growth in the coming years. Concern around recent economic difficulties in China has clouded views of the asset class, encouraging outflows and underperformance. But this means there are now exceptional opportunities for the selective investor.

Stabilisation and improvement in the Chinese economy will support a recovery, but this is just one factor. Look across the asset class – at South-East Asia, the Indian subcontinent and Latin America. Several structural forces should make these attractive for investors over the coming years.

Supply chain de-risking will benefit different countries – some more than others – as companies look to diversify their supply chains, and we also expect to see more ‘near shoring’. Mexico has already been a big beneficiary of this and is now the biggest exporter to the US – a title once held by China.

Meanwhile, greater integration, particularly in Asia, means many emerging countries are now far less reliant on the health of the American or European economies. Nearly two-thirds of all trade in Asia today is carried out within the region. This makes emerging market equities more attractive from a diversification point of view.

We are also seeing many more local champions emerging – whether that is in banks, retail or e-commerce. The opportunity set for investors keeps growing.

Waves of inflation

Finally, we need to talk about inflation. Much of the commentary I have read recently addresses the recent spike in inflation as a one-off phenomenon. It suggests inflation will moderate and interest rates will tumble again. But history suggests inflation usually occurs in waves. This puts pressure on businesses that do not price their goods and services sustainably. It also means the party is over for unprofitable businesses so generously funded by venture capital and private equity. It was a 10- to 15-year party, so the hangover will live with us for some time. Only when a capital cycle moderates does it become clear where money was misallocated. We should be braced for issues in private equity and corporate finance in the coming months. Hangovers hurt!

For investors, it means that what we avoid is as important as what we own. We need to be laser-focused on balance sheets. The rising tide that floated all boats is still going out. We are in a different phase now. While I am optimistic about the outlook for the real global economy, this is a time for investors to be active and selective.