Artemis Strategic Bond Fund update

Juan Valenzuela and Rebecca Young, managers of the Artemis Strategic Bond Fund, report on the fund over the quarter to 30 June 2023 and their views on the outlook.

- The fund returned -1.2% over the quarter, in line with -1.2% return from its sector benchmark.

- Our holdings in gilts and sterling-denominated investment-grade credit were hurt by rising interest-rate expectations.

- We believe fixed-income assets now represent a compelling proposition.

Review of the quarter

Government bond markets were generally weaker in Q2

Inflation remains sticky and central banks are taking rates higher. And although the UK continues to confront a particularly challenging situation with respect to inflation, a lot of rate tightening is already priced in – market expectations that UK interest rates will peak at 6.4% in this cycle look fully priced to us.

Expectations for 'terminal' UK interest rates rose materially over the quarter

Credit spreads tightened

Two important negative ‘tail risks’ dissipated over the quarter, helping to support credit spreads and broader demand for risk assets. First, US politicians struck a deal to raise the debt ceiling with (relatively) little fuss. Second, the stresses in the US banking system eased. And although the banking sector’s problems do not appear to be systemic, they are impacting credit availability, especially in the commercial real estate sector; the Fed’s Senior Loan Officer survey shows lending standards have already tightened. This issue will not go away.

The fund benefitted from investing across a diverse set of assets

Our allocations to dollar and euro-denominated corporate bond markets were positive for the fund’s relative returns over the quarter; sterling-denominated bonds were generally laggards over the period. Our exposures to high-yield bonds were generally some of our strongest positive contributors to performance (we remain predominantly positioned in ‘BB’-rated credit).

Our holdings in sterling bond markets were significant laggards

Those positives, however, were more than offset by our weaker performers, particularly gilts and sterling-denominated investment-grade credit, both of which were hurt by rising interest rates.

We believe fixed-income assets now represent a compelling proposition

We are heading into the late phase of the current economic cycle. The yield environment remains attractive, and the fund continues to benefit from a healthy income cushion – through holding a balanced blend of fixed-income assets with a pronounced ‘quality’ tilt.

Portfolio positioning

The fund remains defensively positioned

We continue to believe the best balance between risk and reward resides towards the higher-quality end of the ratings spectrum – specifically in investment-grade credit, government bonds and higher-rated parts of the high-yield market. We do not have any exposure to emerging-market or additional tier 1 bonds and only modest exposure to corporate hybrids. We have less than 1% invested in CCC-rated credit.

We believe a degree of caution and selectivity is warranted in credit markets at this juncture

Credit spreads have tightened meaningfully over the first half of the year; we believe there is limited room for meaningful further spread tightening from here. Dispersion continues to rise; the market is discriminating between good and poor credit stories to a greater extent –fundamentals increasingly matter. So a selective approach remains key.

The list of casualties of a higher interest-rate regime continues to build, exposing the weak links within real estate, financials and, more recently, the utilities sector. Business models engineered around a low interest rate/low inflation environment will prove vulnerable if central banks need to keep interest rates high to bring inflation back to target (this is our base-case scenario). This remains a stockpickers’ market.

Activity and outlook

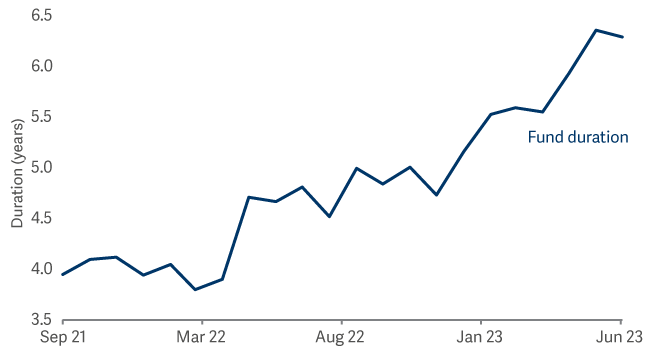

Our appetite for duration (interest-rate risk) has increased

At current yields, valuations are generally more compelling and the market’s interest-rate expectations appear fully priced (especially in the UK). Earlier fears of recession have mostly dissipated. This makes it more likely that economic data will surprise to the downside – and any disappointments should be supportive for fixed income. In a ‘risk off’ environment, government bonds should see meaningful capital appreciation. Another factor arguing in favour of increased duration is seasonality: the summer months tend to be a positive period for government bonds.

So, as valuations became more attractive and began to offer a more asymmetric risk/return profile (skewed to the upside) we increased the portfolio’s duration. By the end of the quarter, the portfolio’s headline duration had risen to around six years, up from five-and-a-half years at the start of the quarter. Our preference is to add duration in the UK and US.

This position is, however, carefully calibrated: we acknowledge that this cycle is different, inflation remains elevated and core inflation is proving sticky. So we remain focused on expressing our views in a balanced manner, we are taking care not to let our view on duration swamp the other views the portfolio expresses.

We are still running very limited exposure to longer dated (>15 years) tenors

It is our view that yield curves are excessively flat – so our duration contribution is mostly concentrated in the front end and ‘belly’ of the curve (5-10-years) in the UK and the US.

We increased the portfolio’s duration as valuations became more attractive

Most of the additions we made to the fund’s credit exposure have been in investment-grade

This reflects the attractive risk/reward in this segment of the market and an active new issue market. We participated in new deals across the sterling euro and US dollar markets from issuers including:

- The AA;

- Nasdaq;

- Close Brothers;

- Arqiva (broadcast);

- Anglo American; and

- Pfizer.

In secondary markets, meanwhile, we topped up our holding in Digital Realty (data centres) and Centene (US health insurer).

Set against that, we trimmed holdings in a few investment-grade names where credit spreads had performed well, including:

- Fiserv (payments);

- Rentokil;

- InterContinental Hotels; and

- BT.

We were less busy in high-yield markets

We trimmed our positions in Sotheby’s (given weaker-than-planned deleveraging) and Biogroup (given rising M&A risk). We sold a position in Graphic Packaging on strong spread performance. In secondary markets, we added to our existing exposure in Center Parcs (following its partial refinancing).Other trades and views…

We have reduced our short position in Canada (via futures) following that market’s significant underperformance.

We maintain a negative view on peripheral spreads and carry limited peripheral corporate risk. We have taken profits on a trade whereby we were short in the eurozone's periphery (Italy) versus its core (Germany).

Source: Lipper Limited/Artemis from 31 March to 30 June 2023 for class I quarterly accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmark: IA £ Strategic Bond NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. It acts as a ‘comparator benchmark’ against which the fund’s performance can be compared. Management of the fund is not restricted by this benchmark.