Five charts: The case for investing in UK equities

Do companies listed in the ‘the world’s most unloved market’ deserve to trade on a historically wide discount to their global peers? And – if not – what will make that change? Five charts help explain why Artemis is proud to fly the flag for UK equities.

1. The valuations of UK stocks are compelling

The UK may be the most undervalued major stockmarket in the world today. Companies listed in the UK are cheap in absolute terms, relative to their own history and compared to other developed markets.

Is the extremity of the discount on which it currently trades relative to its international peers justified? And will it persist? We believe the answer to both questions is a clear ‘no’.

World equity markets valuations versus history

The discount on which UK plc trades today is a product of a narrative of decline surrounding the country as a whole. Whether you agree with that narrative or not, perceptions matter: in the short term, it is sentiment rather than earnings that drives the market.

Ultimately, however, it will be corporate fundamentals – such as dividends and profits – that will determine long-term returns. And here the story about the UK is far brighter than the headlines might lead you to believe…

2. Beyond borders: the FTSE is a globally exposed index

One of the legacies of the UK’s history as a trading nation is that its stockmarket is dominated by companies who find their customers and sales overseas: global banks, energy companies, commodity producers and pharmaceutical giants.

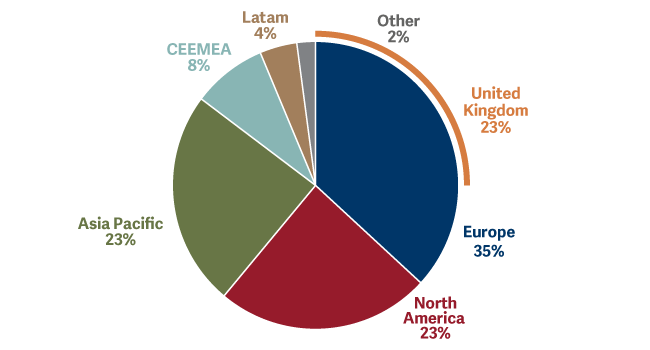

UK revenue by region

Whether investors’ downbeat view of the prospects for the UK economy are justified or not, the fact of the matter is that around 77% of the FTSE 100’s aggregate earnings are actually derived overseas.

So, if you want to gain exposure to the global economy without overpaying, it’s worth taking a look at UK companies.

3. The UK economy is far stronger than the headlines suggest

Is the UK really ‘the sick man of Europe’? Certainly, recent headlines have been bleak. But look more closely and a more complex – and more encouraging – picture emerges. The Bank of England no longer anticipates a recession this year or next. Clearly, some consumers are feeling the severe squeeze from rising food bills, energy costs and mortgage repayments. But fewer than you might think.

- The pain of higher mortgage costs is focused on those households that actually have a mortgage; the majority of households don’t. Moreover, because five-year fixed deals are the most common form of borrowing – only a minority of mortgages are refinanced each year.

- Household bank deposits more than offset that mortgage borrowing and those deposits (c.£1.8 trillion) are starting to earn a meaningful level of interest income.

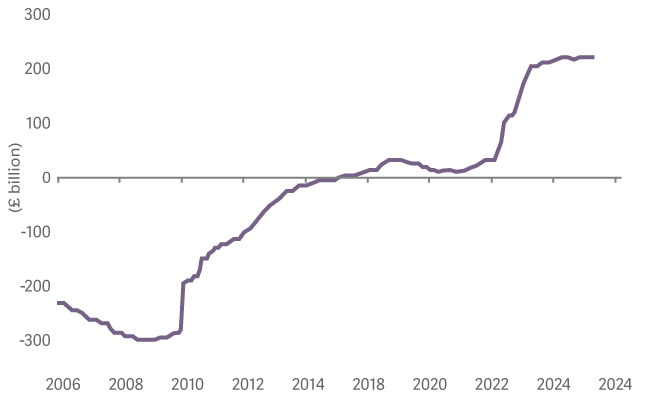

Household bank deposits less loans

So while some UK households are under severe financial pressure, that is far from the whole story. Sceptical? Take a look at the updates from some of the UK’s consumer-focused companies this spring.

- Jet2 recently announced that, in the year to the end of March, its overall revenues were 40% higher than in the last pre-Covid year of trading.

- Whitbread (owner of the Premier Inn hotel chain) announced that trading in the UK was so strong that it was upgrading its earnings guidance for the year ahead.

- Mitchells & Butlers sales grew by 8.5% on a like-for-like basis in the first half.

So the picture is more complex than headlines might imply; many domestically-focused UK companies are thriving.

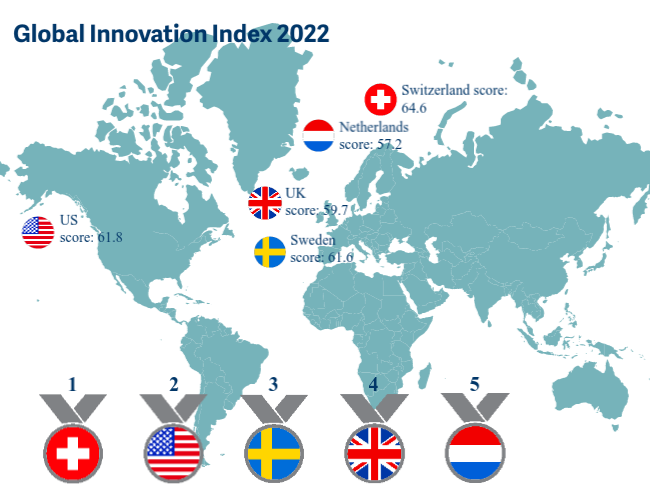

4. The UK is home to a surprising number of world-leading, innovative companies

Like all clichés, the idea that the UK stockmarket is dominated by dirty, extractive old economy industries contains a grain of truth: invest in a FTSE100 tracker and you’ll own your share of miners, oil producers and industrial companies.

But that’s not the whole story: over the past decade, a number of world-leading companies in the UK have invested in technology to reinvent themselves and neutralise the threat from disruptors. So look more closely and what may initially seem like ‘old economy’ companies may actually be something more intriguing.

Take Next, for example. Valued as if it were just another high-street retailer when in reality it has become a technology-driven retail platform with more growth potential than you might realise: its ‘Total Platform’ provides a complete e-commerce solution for other brands, from marketing, online sales through to warehousing, distribution and contact centres.

And it isn’t just Next. Look through the portfolio of our UK funds and you’ll find companies such as:

- Oxford Instruments: sells into high-growth, high-tech areas such as compound semiconductors, quantum computing and life science,

- Pearson: formerly a publisher of weighty academic textbooks, it has become an education company built for the digital age;

- Smiths Group: still valued as a stodgy industrial conglomerate, it is a pioneer in providing engineering solutions to growth markets including the energy transition, data networks and satellite technology.

5. M&A, private equity and share buybacks will eventually close the ‘UK discount’

Today, valuation multiples in the UK are depressed despite the fact that the earnings of many UK companies are rising. So there’s a disconnection. In the short term, negative sentiment continues to deter capital inflows from global investors. At some point, however, that will change – valuations will matter again. In the meantime, three types of buyer are exploiting the discount on which UK equities trade:

- Corporate buyers – using M&A to snap up UK-listed companies.

- Private equity – putting its cash pile to work in an undervalued market.

- UK plc – companies buying back and retiring their own shares.

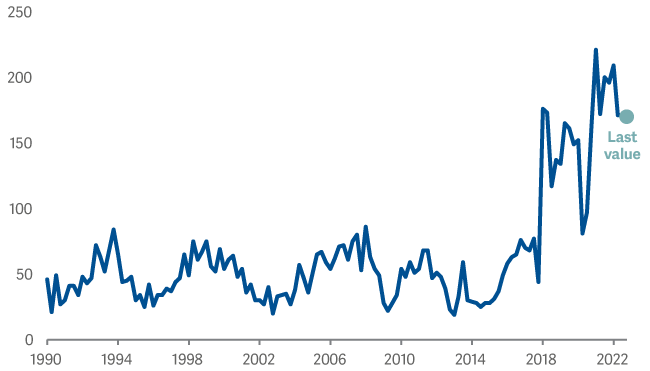

Number of inward UK acquisitions

We believe there is more of this buying to come. Today, investors can buy UK companies who are growing their earnings (and often raising their dividends) at a significant discount to their global peers and simply wait for the market to do its work.

Eventually, the connection between fundamentals and share prices will be re-established: the UK discount won’t last forever.

Download our 5 charts in a client friendly presentation.

Read more on why we’re flying the flag for UK equities.