UK equities – after the gloom, the profits?

With the UK economy having repeatedly defied gloomy predictions, Ed Legget asks whether investors risk missing out when sentiment towards the UK market begins to reflect the brightening macro picture.

In March, Artemis hosted a webinar, Profits from gloom, in which we challenged some common – and usually negative – misconceptions about the UK economy and market. The positive message from our UK equity managers was reinforced by an independent voice: Darren Winder, head of Economics & Strategy at Lazarus Economics.

Since then, economic data has largely borne out the contrarian message we delivered then: that the UK, while undoubtedly facing challenges, is actually in a far stronger position than the consensus believes.

You can watch our latest UK equities webinar with our Artemis UK Select Fund Managers Ed Legget and Ambrose Faulks, recorded on 27 June 2023.

Since our webcast back in March, economic data from the UK has, on the whole, been surprising to the upside. It seems increasingly clear to us – both from that data and from our conversations with UK companies – that momentum is building in the UK economy.

Bank of England now expecting no recession

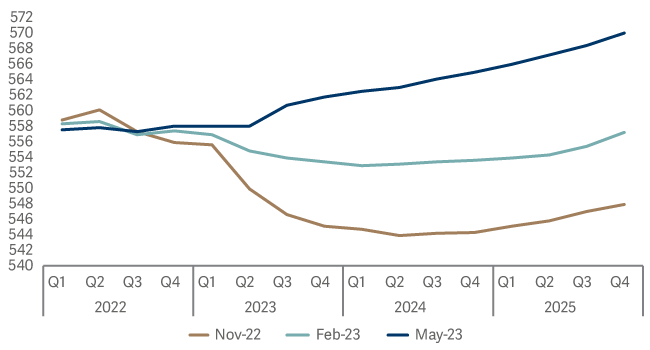

MPC real GDP projections (£ billion)

Perhaps most striking was the about-face by the Bank of England. Six months ago, it was forecasting one of the deepest and the longest recessions in history. But – as we suggested – this didn’t actually transpire: the Bank is now forecasting that there will in fact, be no recession at all. Instead, it now sees economic growth picking up progressively from here.

That positive shift by the Bank isn’t an outlier: economic growth, wage growth and retail sales have all come in ahead of expectations in recent months. On the webcast, we’ll explain why we believe - in contrast to the all-pervasive bearishness - the outlook for the UK consumer is likely to improve from here…

Recent results and trading updates from UK companies have been positive

Clearly, the macro picture matters. But we are investors first and foremost. And the management teams of the UK-listed companies that we meet remain upbeat. In broad terms, they are seeing a strong re-bound in trading as improved demand encounters a reduction in supply.

In our portfolio, the following companies have either beaten expectations or meaningfully raised guidance in recent months: 3i; AstraZeneca; Barclays; BP; Flutter; HSBC; IPF; IAG; Lloyds; Melrose; Morgan Sindall; NatWest; Oxford Instruments; Shell; WH Smith; Standard Chartered; Virgin Money; Whitbread.

Investors are currently discounting these improvements, seemingly on the basis that ‘trading is fine now but what about next quarter?’ While we could sympathise with that argument last year, there are now genuine reasons to be more optimistic about the UK economy.

The UK market remains cheap

Finally, a simple point: the UK market cheap in absolute and relative terms, trading on just 10.1x forward earnings. This represents a significant discount to the S&P 500 on 19.3x earnings and the Nasdaq on 27.2x.

Growth vs value - back at highs

Risk off drives down value