Four charts: the ‘golden buying opportunity’ in UK smaller companies

Perceptions of the UK economy are finally starting to change for the better. As Mark Niznik and William Tamworth explain, however, valuations of the UK's smaller companies have yet to reflect that shift. Is that helping to create “a golden buying opportunity”?

- UK smaller companies are unloved and, we believe, deeply undervalued.

- Interest rates are expected to fall next year and sentiment should begin to improve.

- Periods of weak returns from UK smaller companies have historically been followed by periods of extremely strong performance.

- A surge in takeover bids suggest trade buyers have already spotted a buying opportunity.

It shouldn’t come as a shock that we’re strong proponents of investing in smaller companies. It would be strange if we weren’t: we’ve spent our careers analysing their financial statements and business models, talking to their management and – if we like what we hear – investing in them. It’s an interesting job. To be blunt, however, we also invest in smaller companies because they deliver superior returns over the long term.

Put debates about the ‘small cap effect’ to one side and consider this simple fact: data from Numis, who calculate the index we benchmark our performance against, shows that if you had invested in UK smaller companies in 1955 you would have grown your wealth by 368 times by the end of 2022 (providing you reinvested your dividends). An investment in UK larger companies over the same period would also have multiplied your wealth, but by a more modest 55 times1.

So, if you’d talked to either one of us over the past decade, we’d have urged you to either retain or make an allocation to smaller companies. But we wouldn’t always have been able to make a claim as bold as the one we make here: investors in UK smaller companies are currently being presented with a golden buying opportunity.

1) Strong returns follow weak returns

While smaller companies outperform their large-cap peers over the long term, there’s a hitch: they don’t deliver that outperformance smoothly. It would be lovely if the Numis Smaller Companies index were to simply outperform the FTSE 100 by, say, an even 3% each year (its average annualised outperformance since 1955). It doesn’t. Instead, smaller companies deliver their outperformance in unpredictable fits and starts. Frustratingly, there have also been periods in which they significantly underperform the broader market.

Numis UK Smaller Companies - 5 year annualised returns close to historic lows

Buying at these levels has worked well in the past…

| One year | Three years | Five years | |

|---|---|---|---|

| November 1974 | 102% | 298% | 508% |

| July 1992 |

26% | 47% | 95% |

| September 2002 | 35% | 104% | 177% |

| February 2009 | 66% | 123% | 263% |

| May 2012 | 39% | 83% | 123% |

| March 2020 |

66% | 51% | ?? (*) |

| September 2022 | 12% | ?? (*) | ?? (*) |

| Average | 51% | 124% | 261% |

This is pertinent today because periods of weak returns have historically been followed by periods of very strong performance. On the five last occasions that trailing five-year returns from small caps have fallen to zero, average returns over the following five years have been 261%.

We are, of course, obliged to warn you that past performance is no guide to future returns. But it is a striking fact that buying smaller companies when everyone else has given up on them tends to have worked extremely well.

2) Valuations are close to their lowest levels in a decade

Today, the valuations of UK equities in general are significantly lower than those of their peers in other developed markets. The valuation discount on which smaller companies trade is even wider. Why? Negative sentiment towards the UK economy has resulted in persistent outflows from UK assets and particularly from the smaller companies market. The Investment Association’s UK Smaller Companies sector has seen net outflows every calendar month since the middle of 20212.

Fund valuation near a 10 year low

Artemis UK Smaller Companies - 12m forward P/E (weighted median)

The result is clear: valuations have moved lower. Look at a simple measure of value – price-to-earnings multiples. On that basis, the average valuation of the holdings in our portfolio is not far above its lowest level in a decade.

3) Interest rates expected to fall next year

Today, smaller companies look cheap relative to their own history, relative to the wider UK market and relative to other equity markets. Moreover, periods when five-year annualised returns are as low as they are today have typically been followed by periods of very strong returns. But what might trigger a reappraisal of smaller companies?

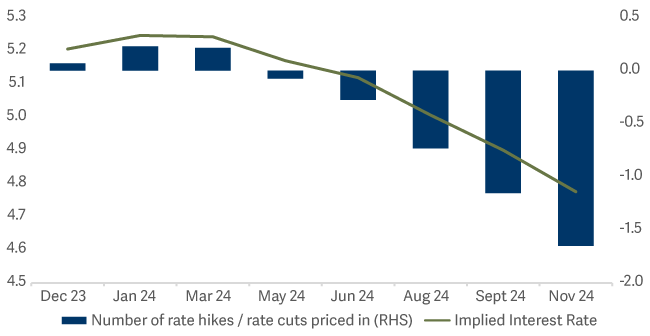

The market now expects interest rates in the UK to start falling in the first half of 2024

One potential candidate is the ongoing gradual improvement of economic conditions and sentiment. Inflation is easing, data revisions mean the UK is no longer the post-pandemic laggard among the G7 economies and, despite Governor Bailey’s protests to the contrary, the market expects the Bank of England to cut interest rates in the first half of 2024. Together, that could provide a trigger for sentiment to improve. In the meantime, however, another group of buyers is taking advantage of temporarily depressed valuations …

4) Takeover activity is unusually high

Our fund invests in between 60 and 90 stocks. Even within that focused portfolio, however, we have seen 27 recommended offers for our holdings since 2019. The average premium attached to those offers has been 50%. This year alone, we have seen recommended bids for four of our holdings: Medica, Lookers, Kin & Carta and ScS.

Number of inward UK acquisitions

We see these bids as third-party validation of the value we perceive in our holdings. If fund investors don’t buy UK smaller companies, then trade buyers will. As one Bloomberg columnist recently put it “The more they buy, the more it becomes obvious to the rest of the market that they should get in first.”3

We’re getting in first; if you don’t already have an allocation to the Artemis UK Smaller Companies Fund, perhaps you should join us.

2Source: The Investment Association as at 31 October 2023

3Personal Wealth: UK's Small- and Mid-Cap Companies Are Irrationally Cheap - Bloomberg