How to profit from a rising bond market: look beyond duration

Adding duration allows bond investors to profit as interest rates fall – but too much can bring alarming levels of volatility. David Ennett explains why there’s another, better way for active managers to generate excess returns in the bond market.

A proverb suggests that “there’s more than one way to skin a cat”. I’ve never wanted to put that to the test, so I don’t know if it’s true. But the point conveyed by this grisly image – that there’s more than one way of achieving any goal – certainly applies to investing in bonds.

If you’re positive on prospects for the bond market (as we are) there are a number of ways you can express that view. You can, for example:

- Add ‘duration risk’ – make your portfolio more sensitive to a fall in interest rates, giving it directional exposure to lower bond yields.

- Add ‘beta risk’ – add generic credit risk by buying investment-grade or high-yield corporate bonds. In return for taking on a degree of directional credit risk, you’ll get an enhanced yield.

There is, however, another driver of returns that is often overlooked: adding ‘specific risk’ via stock selection. Using detailed credit analysis to identify the most attractive assets in each pocket of the bond market can dramatically enhance the returns from making the right calls on duration and credit beta. Adding specific risk can mean that you don’t have to take as much outright duration or beta risk in portfolios to achieve the returns you’re looking for.

Let’s look at a worked example. Assuming that, last November, you shared our belief that rate cuts were coming, how would you have looked to reflect that view in your portfolio?

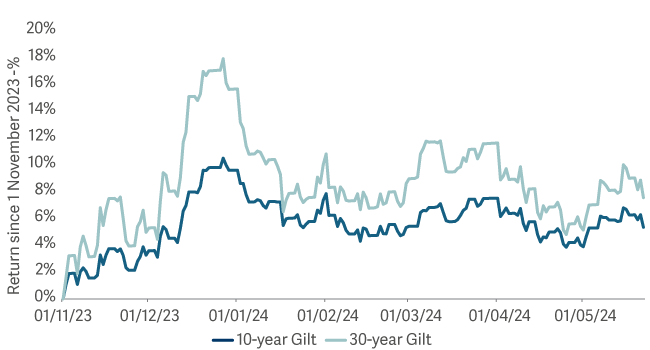

1. Adding duration

The most obvious way to profit from a fall in UK interest rates would have been to buy a government bond such as a 10-year Gilt. Typically, a 10-year Gilt has around 6.7-7 years of duration. Over the last six months, you’d have enjoyed a return of 5.4% from owning a 10-year Gilt. That’s a useful return from a high-quality asset, but it has come with significant volatility.

Adding duration increases returns but reduces volatility

If you had been supremely confident that rate cuts were coming and you wanted to maximise your return, you might have added more duration by buying a 30-year Gilt, which runs with just over 16 years of duration. That would dramatically increase the interest-rate risk in your portfolio. Although adding that directional exposure would have increased your returns to 7.6%, it would have come at the cost of significantly greater volatility.

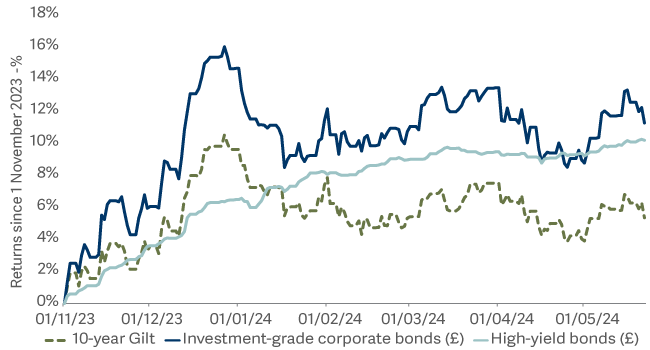

2. Adding credit beta

What other strategies might you have followed? You might have chosen to make an asset allocation call by adding some credit risk to your portfolio.

Adding credit risk can enhance returns

Adding generic long-dated investment-grade corporate bonds would have worked well, delivering a return of around 11%. But it would have come at the cost of a notable degree of volatility due to the increased risk taken.

Alternatively, had you wanted to express a stronger view on the prospect for economically sensitive risk assets, you might have chosen to allocate to sterling-denominated high-yield bonds. (The higher yield and shorter maturity profile of the high-yield market means it carries less duration risk but more credit risk.) The return here would have been lower than from longer-duration strategies, but it would have been delivered with significantly less volatility.

3. Adding ‘specific risk’: focus on credit selection

Making the right calls on duration risk and credit risk clearly matters. But careful credit analysis has the potential to dramatically enhance the returns from getting those calls right.

To take one example, there was a huge degree of negativity towards UK’s housebuilders towards the end of last year. Higher mortgage rates had put house prices under pressure. But the prospect of rate cuts in 2024 had the potential to catalyse a shift in sentiment towards the sector.

In that instance, it might have been reasonable for you to add Miller Homes’ 2029 bonds to your portfolio. These are ‘split-rated’, falling somewhere between a ‘BB’ and ‘B’ rating; they are not towards the high-risk end of the high-yield market. So, the risk of default is fairly low, and they also carry a fairly low degree of duration. Returns from owning this bond over the last six months have been impressive. The returns here came from duration and credit beta (as with the first two examples) but were enhanced by a number of specific risks.

Most obviously, Miller’s earnings appeared particularly well positioned to benefit from lower mortgage rates and stronger housing demand in the UK. In addition, negative sentiment towards the UK economy (in general) and rate-sensitive sectors such as housing (in particular) gave the bond significant valuation support from which to rally.

Identifying the right bonds can deliver superior returns without adding volatility

My point here isn’t about Miller Homes but about the incredible opportunities available to stockpickers. Within each pocket of the bond market, we would argue that it is possible to find specific assets with superior risk/reward characteristics. (My experience in running Artemis’ dedicated high-yield strategies and the high-yield element of the Artemis Strategic Bond Fund suggests those opportunities are particularly apparent in the high-yield market.) If they have the expertise to find them, investors have the opportunity to generate excess returns without taking outsized directional risks on duration or credit beta.

Duration and asset allocation still matter – but they are not the be-all-and-end-all. What’s bad news for felines is good news for (active) bond investors: there’s more than one way to skin a cat.