Why we renamed the Artemis Target Return Bond Fund

Short-dated bond funds can provide a more attractive option to money market funds when interest rates begin to fall.

In the wake of the financial crisis, a plethora of ‘absolute return’ bond funds appeared. They made perfect sense given the investment climate at the time: base rates in the UK were historically low and cautious investors had been terrified by the extreme volatility in financial markets.

Absolute return bond funds offered a solution. I was part of that process, launching an Absolute return bond fund in 2011. The fund resonated with clients and was soon soft closed when it raised over £2bn.

Shortly after joining Artemis in 2019, we launched the actively-managed Target Return Bond fund. While not an absolute return fund, it also sat in the IA Targeted Absolute Return sector. Its (slightly longwinded) objective was ‘to achieve a positive return of at least 2.5% above the Bank of England (BOE) base rate, after fees, on an annualised basis over rolling three-year periods.” In other words, our goal was to give investors a positive return on their money – but with lower volatility than in long-only bond funds.

Fund performance relative to the investable universe

Putting modesty briefly to one side, we believe the returns we have delivered since launch have been very good. Equally, however, there is a strong case to be made that running a fund the IA Target Absolute Return sector today makes less sense than it did. So, what’s changed?

Shorting bonds has become expensive

A true absolute return fund attempts to remove all market directionality. In its purest expression, it does this by offsetting every long position with a short one. Shorting was cheap when interest rates – and bond yields – were low. (That was why we saw an avalanche of absolute return vehicles appearing in the era of QE (Quantitative Easing) and ZIRP (Zero Interest Rate Policy) ). Today, however, QE is over and interest rates have normalised. Put simply, shorting bonds is vastly more expensive than it used to be.

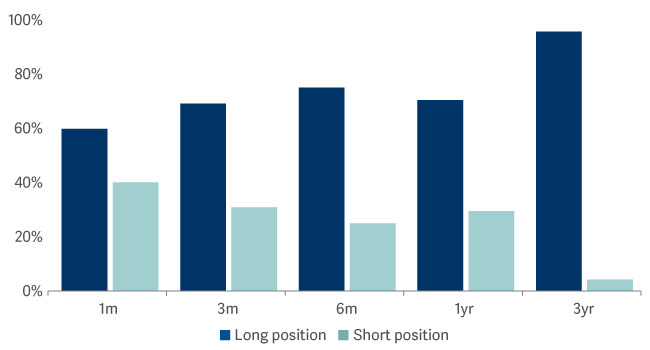

Being short is expensive

To make money being short you need to be right and quick.

Probability of profiting from Xover CDS Index

While you can still make money by being short, you not only need to be right – you need to be right quickly. Remember that when you own a bond, you continually receive income (ordinarily, the bulk of returns from investing in bonds comes through these income payments). But if you short a bond, the opposite occurs: you’re continually paying out income. This massively skews the odds of success against you. The longer you hold your short position, the more income you’re paying out – eating into the gains your clients will eventually see when (or if) your short position comes good. When interest rates are this high, shorting is something that should only be done fleetingly.

It is because of the mathematical certainty that the probability of making money by being short in fixed income is so low, that when we came to Artemis we did not replicate our old fund – we did not launch an absolute return fund. The shift to a higher interest-rate regime has only exacerbated that dilemma to managers of absolute return bond funds today.

The dilemma facing absolute return bond investors

When bond yields are high, it is simply illogical not to earn that income. The income generation is too great to ignore. Albert Einstein said compound interest is the 8th wonder of the world. Now that interest rates have ‘normalised’, we believe we can still deliver a relatively low-volatility strategy – but it must be unashamedly directional. So, in early March, we wrote to investors in the Artemis Target Return Bond Fund and asked them to allow us to change the fund’s investment objective, its benchmark and its name. They overwhelmingly voted in favour of the changes we suggested.

As a result, from 18 March 2024 the fund will be called the Artemis Short-Duration Strategic Bond Fund. Its benchmark will change to a short-dated bond index, the Markit iBoxx 1-5 year £ Collateralized & Corporates Index. (We have also applied to move the fund to the IA’s £ Strategic Bond sector. That decision, however, lies in the gift of the Investment Association).

Are money market funds really the best place to be?

I believe absolute return bond funds were the right solution at the right time. But it is time to move on. Today, investors are voting with their feet. Assets under management in the IA’s Targeted Absolute Return sector, once the IA’s third-largest sector, have more than halved, dragging it down to 13th place in the rankings.

Some of that money appears to have gone into money market funds. But is cash really the best place to be? Base rates are at levels last seen in 2006-07, a time of (seemingly) solid economic growth. That is not where the UK economy is today: base rates are far too high and will need to fall from here.

If not cash, then where? In the current economic environment, short-dated, investment-grade corporate bonds appear to be the natural home for investors seeking a low-beta, cash-plus return. Yields on investment-grade bonds are now comfortably beating inflation. As for the case for short-dated bonds? A lot of new bond issuance is in the pipeline from governments across the West (not just the UK) over the coming years. This means a degree of selectivity is required and tempers our enthusiasm for long-dated bonds. Yields at the short end of the curve could fall faster and further than those at the long end of the curve.

A little more flexibility can lead to significantly better returns

So, from a risk-adjusted point of view, we believe short-dated corporate bonds are the place to be. Buy short-dated credit and you get a very healthy yield in exchange for taking very little credit and interest-rate risk. But that does not mean they are the only place to be. Investors whose mandate affords them a bit more flexibility can differentiate themselves and do significantly better. And we have…

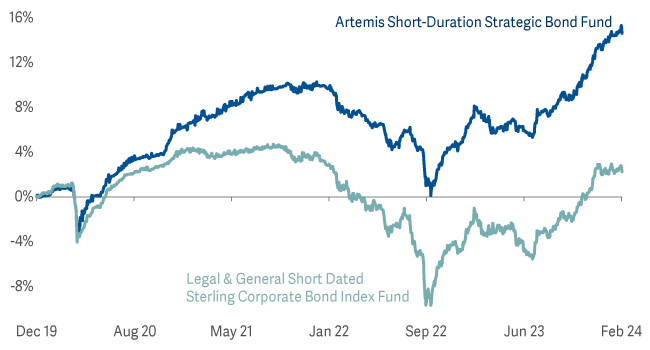

Artemis Target Return Bond Fund relative performance

Relatively speaking, the Artemis Target Return Bond Fund has been one of the top-performing bond funds since its launch. And while it has unapologetically always been a fund with short-dated corporate bonds at its core, it has substantially outperformed the short-dated investment-grade index (by 11%).

In part, this is because the narrowness of the index means short-dated, investment-grade bond funds tend to be relatively homogeneous and undifferentiated. Our slightly more flexible approach has given us the freedom to invest in other parts of the bond market, allowing us to find income and returns elsewhere:

- Selectively dipping into high-quality, high-yield credit.

- Buying Gilts, Treasuries and other government bonds

- Selectively owning index-linked bonds; and

- Using some of the tools in the kit of an absolute return manager – such as selectively shorting where we see outstanding opportunities.

We’ll continue to use these tools in running the Artemis Short-Duration Strategic Bond Fund. In fact, how we manage the fund will not change despite the change in name and performance benchmark.

When the facts change...

Since December 2019, the Artemis Target Return Bond Fund has delivered a double-digit return at a time when bond markets all but collapsed. But things have moved on. The facts have changed. And, like Keynes said, when the facts change, I change my mind.

Given our reservations about taking a purely ‘absolute return’ approach back in 2019, and those concerns are even more acute in today’s bond market, we believe changing the fund’s name and benchmark better explains to our clients what we are trying to achieve and what return outcomes they should expect. Clients will still be getting what they were looking for: relatively low volatility but with the potential for better returns than sitting in cash (particularly as interest rates start to fall). Market conditions and fund names may change, but most people’s investment goals do not.

Stephen Snowden is Head of Fixed Income at Artemis and co-manager of the Artemis Short-Duration Strategic Bond Fund with Liam O’Donnell and Jack Holmes.