Artemis Positive Future Fund update

Sacha El Khoury manager of the Artemis Positive Future Fund reports on the fund over the quarter to 30 September 2024 and the outlook.

Source for all information: Artemis as at 30 September 2024, unless otherwise stated.

- - The Artemis Positive Future Fund returned -3.9% (sterling, net of fees) in the third quarter, underperforming MSCI ACWI which returned +0.5%. The fund also underperformed the MSCI ACWI Mid Cap index, which returned +3.7%.

- Stock selection drove the fund’s underperformance, with holdings in the industrials, health care and information technology sectors among the weakest performers over the quarter.

- Portfolio activity remained elevated in the third quarter as the fund continues to transition to its new impact investing approach.

Market review

The third quarter was volatile for equity markets. There was a significant amount of newsflow and noise – concerns about economic growth, both rate cuts (US and Europe) and rate hikes (Japan), a flash crash in Japan, elections, assassination attempts, and a significant program of stimulus announced in China. Global equities finished the period marginally positive with the MSCI ACWI index gaining +0.5%.

Returns were their broadest for quite some time, with some of the largest technology companies underperforming and something of a rotation to small and mid-cap equities. It follows that the MSCI ACWI Mid Cap index outperformed, gaining 3.7%.

With respect to style, Value significantly outperformed Growth, with the ACWI Value and Growth indices returning +3.4% and -1.8% respectively; smaller companies also outperformed their larger counterparts, with the ACWI SMID and Large Cap indices returning +3.2% and 0.0% each.

Emerging markets posted strong returns in the third quarter, given a weaker dollar (as a result of US rate cuts) and the announcement of a significant programme of monetary and fiscal stimulus in China. Chinese equities posted their strongest week of returns since 2008 towards the end of September.

Portfolio performance and attribution commentary

The Artemis Positive Future Fund returned -3.9% (sterling, net of fees) in the third quarter, underperforming MSCI ACWI which returned +0.5%. The fund also underperformed the MSCI ACWI Mid Cap index, which returned +3.7%.

This underperformance was driven by stock selection. Largely, the underperformance came from the fund’s holdings in technology (particularly semiconductors, which were weak in the third quarter given some disappointing earnings reports), industrials (concerns around economic growth given moderating US macroeconomic data) and healthcare (some stock-specific issues).

The most significant contributors to underperformance were as follows:

Semiconductor software and service provider Synopsys sold off with the broader semiconductor sector. It was further impacted by Intel’s (a Synopsys customer) profit warning and R&D cut. Synopsys' strong competitive position in EDA (electronic design & automation), an effective oligopoly with only one other player of Synopsys' scale, should support robust pricing power and in turn healthy long-term cash flow generation and margin progression as demand for Synopsys’ software continues to grow.

Japanese semiconductor equipment company DISCO was caught in the crossfire of a selloff in both semiconductor shares and Japanese equities more broadly. As a market leader with 70% share in dicing and grinding equipment, DISCO has plenty of attractive characteristics and is well positioned in the structurally growing semiconductor industry. However, we have continued to reduce our position given DISCO’s high valuation and the relative attractions of Synopsys, which we believe to be a higher-quality company.

Pharmaceutical clinical research provider ICON fell amid more reports of a weakening funding environment in the biotech industry. We have been reducing our position, given the elongating cycle and the risk to short-term earnings. But ICON continues to take share in large pharmaceuticals, and while the timing of biotech recovery is uncertain, it remains a growing industry. 18x forward P/E for a company that should be able to compound solid high-single-digit EPS growth looks like a reasonable risk reward in our view. Despite the attractive valuation, we remain vigilant of any sign of thesis drift or break.

On the positive side:

Enterprise security and public safety technology provider Motorola Solutions Inc (MSI) beat estimates and raised guidance in its second quarter results. The business looks to be well underpinned by structural growth in demand for its products and services. A significant proportion of its revenues derive from the US government. Its strong competitive positions across a wide range of security and communication applications should underpin high-quality earnings growth going forward. MSI’s multi-year track record of consistently beating and raising guidance (exactly as it did last quarter) is illustrative of the quality of both its management team and cash flow.

Japanese helmet manufacturer Shoei was strong in the third quarter. However, in the wake of a meeting with management that revealed a change in direction in capital allocation, we decided to sell the position. We see M&A outside of the company’s core markets as a negative, as it suggests declining confidence in the earnings algorithm of Shoei’s core business.

Medical technology company GE Healthcare Technologies – spun out of General Electric in 2023 – outperformed. It has a strong and defensible position in the global market and after years of under-investment is accelerating its product innovation particularly with respect to the integration of AI into its various diagnostics and imaging capabilities. Given its heritage and expertise across a wide range of medical technologies, we believe the company has significant optionality for future growth. With this in mind its valuation of 21x forward P/E looks reasonable.

Portfolio activity

Another busy quarter saw the fund continuing to transition to its new investment approach following the appointment of a new lead manager earlier in the year. From a portfolio construction point of view, there is now increased focus on risk-adjusted returns. As such, we have exercised greater discipline around valuations and margins of safety and have been ruthless in exiting positions where valuations are unsupportive or where our investment theses have weakened. We believe the result is a more robust and more balanced portfolio – one that should deliver more robust risk-adjusted returns. While we go through this process, turnover in the portfolio is much higher than our long-term expectation of 20-30% per year.

Purchases

Ventas

A US diversified healthcare REIT (real estate investment trust). This is a reasonably valued REIT operating in a very positive environment. There is limited supply in senior housing coinciding with favourable demographics as 85+ year old cohorts outpace any other demographic in the US. Costs look to be easing just as utilisation and pricing look more favourable.

Beazley

A UK-listed specialist insurer. The company is well capitalised with strong solvency. It is trading – on 1.3x book value – at a multi-year low. For a company with a robust track record in a range of specialist underwriting markets, including cyber security and natural catastrophe, we believe this to be an attractive entry point.

Carrier Global

A US heating, ventilation and air conditioning (HVAC) company. It has a much improved balance sheet and better capital allocation. With signs of recovery in its end markets, it is trading on a discounted valuation versus industry peers.

AIA

Asian life insurer based in Hong Kong. Low insurance penetration and rising GDP per capita in Asia should support growth in demand. AIA is offering attractive shareholder returns through a combination of dividends and buybacks.

Sandoz

A biosimilar manufacturer which spun out of Novartis in 2023. A large number of biologics are losing exclusivity over the next few years, and Sandoz is particularly well placed to deliver on its growing pipeline of biosimilars. These generic biologic drugs that are not only more challenging to produce – and therefore have limited competition – but can also command better pricing.

Centene

A US Managed Care Organisation (entity focused on limiting health care costs). Centene has net cash on the balance sheet. On 11x P/E the stock looks to be undervalued with an eye to improving pricing and long-term structural growth in Medicaid spending in the US.

Vertiv

A US based manufacturer of power and heat systems. Vertiv’s sales are heavily skewed to data centers and benefits strongly from the rise of AI. This is because it offers a solution to a very complex problem – how to cool down data centers when AI driven components are taking off. The short- and medium-term sales are very well under-pinned by their customers’ very public capex plans and we took advantage of a reversal in sentiment to buy into what we think is a high quality industrial, at a very reasonable price.

Bureau Veritas

A France based testing, inspection and certification business. After several years of slow revenue growth,

we see a much more balanced risk/reward opportunity for this company.

SSE

A UK utility company, which we believe has a long and underappreciated runway of structural growth given its ownership of large swathes of the seabed around the UK. It also has a secured offshore wind pipeline of 9GW.

SMC

A Japanese automation company which is the global market leader in pneumatic equipment. The shares have pulled back this year, and therefore offer an attractive entry point.

Sales

Dexcom

A medical device manufacturer. Disappointing first half results raised questions about future competition. We therefore sold the remainder of our holding, which we had been reducing for some time.

Halma

We sold the last of our holding in safety system manufacturer Halma. The company holds a strong competitive position in some attractive (and growing) end markets but the shares have re-rated to over 29x earnings. This premium valuation, as well as growing execution risk given the recent retirement of the chief executive (who spent 18 years at the helm of the company) led us to recycle the capital to other areas of the portfolio.

Shoei

We sold this Japanese helmet manufacturer in the wake of a meeting with management that revealed a change in direction in capital allocation. We see M&A outside of the company’s core business as a negative, as it suggests declining confidence in the earnings potential of Shoei’s core business.

Willscot Holdings

We sold this portable storage/workplace solutions provider, after its attempted purchase of an industry peer fell through.

Amplifon

We sold out of hearing technology company Amplifon, a position which we had reduced consistently from the 4% initial weight in March. The stock is priced for consistent and resilient delivery. The company however continues to disappoint and its execution has been sub-par.

Monolithic Power

US based power semiconductor company Monolithic Power had held up relatively well in the AI sell off. We struggled to find a decent margin of safety, so we were happy to exit.

Cochlear

We had been selling the position down since March as we saw risks building to the investment case. We finally exited the position in August.

Veralto

Water purification system manufacturer Veralto, given some strong share price performance and a re-rating to a multiple than now exceeds that of the market leader.

Engagement activity

During the quarter, we met with nVent Electric’s CEO and investor relations, the US listed global provider of electrical protection and connection products, selling into diverse end markets including industrial manufacturing, construction and commercial buildings, data centers, and utilities. We identified the company as a priority company for net zero engagement as it falls under an emissions heavy sector, and it is ‘not aligned’ with the industry standard’s Net Zero Investment Framework (NZIF). During the meeting we discussed the company’s net zero strategy, as well as their longer-term ambitions to reach net zero.

We applauded nVent’s efforts in setting realistic and achievable short-term targets to decarbonise but have indicated that we would still like them to commit to a longer-term ambition as this would signal intentionality over longer-term capital allocation. We were encouraged by the receptiveness from Beth Wozniak, the CEO. She appreciated our feedback on their strategy, and thought our views on setting longer-term ambitions were helpful. We have since followed up with nVent to share the NZIF and best practice examples from peers. We will continue the dialogue with the company and hope to see the feedback taken on board.

We also recorded our first milestone in the quarter since taking over the fund earlier this year. US based consumer packaging company Graphic Packaging has set a long-term ambition to reach Net Zero by 2050, following our meeting with the Chief Sustainability Officer in June where we had explicitly discussed their long-term aspirations and expressed our expectations by sharing the Net Zero Investment Framework. We will be catching up with the company in the coming weeks to discuss their recently published ESG report, and we will be following up on some of their circular economy initiatives which are central to our engagement agenda with them.

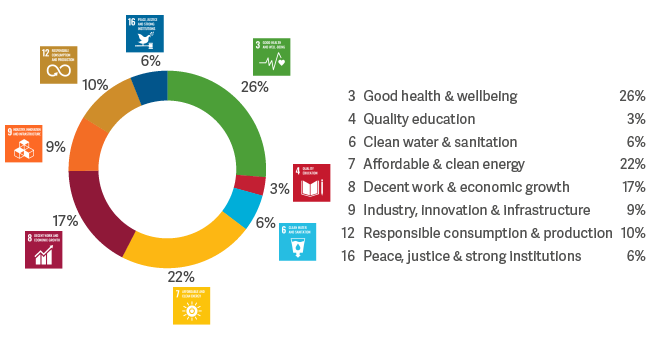

As for the impact that companies deliver through their products and services, we report this in 2 ways: the first is by aligning the companies’ revenues to the various UN Sustainable Development Goals, and the second is by looking at impact KPIs (the metrics are reported by a third party ESG data provider netpurpose).

Product Impact by SDG

Mapping the portfolio company revenues alignment to the UN Sustainable Development Goals

Impact highlights

Impact delivered by our portfolio companies' products and services

Outlook

China’s substantial package of monetary and fiscal stimulus – in combination with a 50 basis point interest rate cut in the US – could serve as a significant boost to the global economy and in turn to equity markets. However, volatility is likely to continue, given a US presidential election and a wide range of potential macroeconomic shocks waiting in the wings.

Despite the obvious challenges, these competing narratives should result in attractive opportunities for active stock pickers, particularly as small and mid-cap stocks are currently trading at a multi-year low discount to all caps. We continue to focus on resilient businesses with good cash flows – in conjunction with our new impact investment approach – and feel optimistic as to the portfolio’s ability to deliver attractive financial and non-financial outcomes for our investors.

Source: Lipper Limited/Artemis to 30 September 2024 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: MSCI AC World NR. IA Global NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ‘comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.