Artemis Short-Duration Strategic Bond Fund update

Stephen Snowden, Liam O'Donnell and Jack Holmes, managers of the Artemis Short-Duration Strategic Bond Fund, report on the fund over the quarter to 30 September 2024.

Source for all information: Artemis as at 30 September 2024, unless otherwise stated.

Performance

A positive quarter for bond markets saw central banks worldwide responding to easing inflationary pressures and slowing economic growth by cutting interest rates. Yet while the overall direction of travel was positive, there were periods of elevated volatility. So, while we remain constructive on the outlook for bond markets, these are conditions in which investors are best served not by taking a buy-and hold approach but rather by thinking and acting tactically.

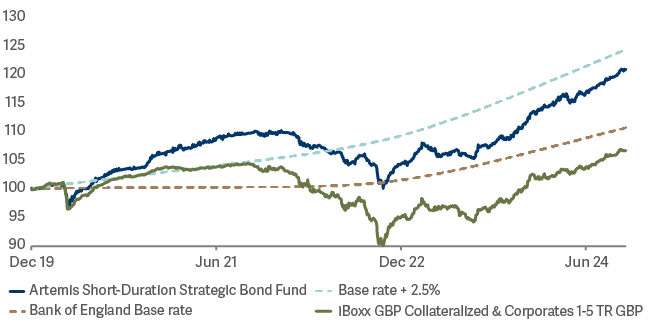

The fund delivered another solid quarter, returning 2.8% versus 2.3% from its benchmark, the Markit iBoxx 1-5 year £ Collateralised & Corporates Index. Both of the fund’s strategies – credit and rates – generated positive returns. Over the year to date, meanwhile, the fund has returned 6.6% versus 5.4% from the benchmark1.

It is hard to conceive of a more supportive outlook for a fund whose core allocation is to short-dated investment-grade corporate bonds. Yields across the investment-grade bond market – including those on short-dated investment-grade bonds – are attractive. Central banks, meanwhile, are cutting rates. This is unhelpful for money market funds but incredibly supportive for short-dated bonds, which are particularly responsive to policy rates.

Fund performance relative to benchmarks (old and new)

Fund performance relative to money market funds

Contributors

The fund’s credit and rates modules both made useful contributions to returns over the quarter. Within the credit module, the contributions came from a typically broad list of names, including bonds from:

- Medical Properties Trust;

- Telereal;

- Lloyds;

- HSBC;

- Bayer;

- Quadgas;

- Grainger;

- Kier;

- Meadowhall Finance; and

- CPI Properties.

Within the rates module, our positions – which included a number of short-term tactical relative value trades and curve trades – continued to deliver incrementally positive returns in exchange for modest levels of risk.

Detractors

In an otherwise positive quarter for the credit module, the largest detractor was a position in Thames Water. In July, Ofwat made its initial determination on the allowable returns for investors in water companies. We had hoped for a degree of pragmatism from the regulator. That pragmatism has yet to materialise. Relative to Ofgem, the gas and electricity regulator, Ofwat’s proposals allow for a lower return on equity and model a lower cost of debt. This led to a series of negative moves by the rating agencies. Water company credit spreads widened, pushing their real-world funding costs higher. This made it less likely that equity investors will commit further capital.

Having fallen in response to Ofwat's draft determination, Thames Water’s bonds bounced in mid-September. At that juncture, we sold our position. The pricing had begun to imply the market was taking an optimistic view as to the severity of the haircuts that may eventually be imposed on bondholders. The bonds have fallen again since we sold.

Activity and positioning

| Bonds | Longs | Shorts | Overall | |

|---|---|---|---|---|

| High-yield | 24% | 24% | -1% | 23% |

| Investment-grade | 57% | 61% | -1% | 60% |

| Government | 13% | 72% | -38% | 47% |

Credit module

Realty Income – We added a new issue from this high-quality retail landlord whose focus is on the US.

Relative value switches – We made a number of relative-value switches between bonds from the same issuer. These included Rabobank, CPI Property and Barclays.

We sold French bank bonds – The fragility of the coalition pieced together by Michel Barnier would not appear to be conducive to fixing the country’s perennial budget deficit problems. While that is not ‘new’ news, French government bonds have weakened. To this point, however, French corporate bonds have not. This sangfroid may not last forever, so we have taken the precaution of selling the last of the fund’s remaining French bank exposure.

We recycled the capital from French banks – We added a new issue from ING and topped up an existing position in Bank of America.

We bought Bayer’s hybrid bonds – This was a switch from an existing holding. Bayer’s new issue was somewhat controversial. Moody’s now allows companies to issue hybrid bonds at a credit rating only one notch lower than conventional bonds (rather that the traditional two). It is also allowing new hybrid bonds to be less subordinated than existing hybrid bonds. The market’s assumption was that no company with a large estate of existing hybrid debt would issue in the new format and so subordinate its existing investors. But Bayer did it anyway. Obviously, it is preferable to be in the new ‘better’ bonds. So, we switched out of Bayer’s existing hybrid bonds into its new ones.

Rates module

Much of our activity in the fund’s rates module over the quarter was tactical and short-term in nature. For example:

- At the start of August, we increased the size of a short position in 10-year Japanese government bond futures following a rally. At that point, we felt markets had gone too far in anticipating future rate hikes by the Bank of Japan.

- Towards the end of August, we began to rotate the short in Japan into European markets like France and Germany, where we anticipated bond supplies picking up in September.

- In September, we added Australian duration back into fund (through 10-year futures) versus Canada. Australian government bonds had underperformed going into the August month end.

- On a more strategic level, we added two positions in the second half of the quarter:

- A US swap curve forward steepener. The forward curve looked very flat and we believe the easing cycle should see the longer end of the curve underperforming. This is a lower-beta approach than implementing a simple cash expression of a steepener trade. It is also easier to hold and will, in theory, exhibit less volatility. In terms of longer-term trades, we believe this position has excellent risk /reward characteristics.

- We went long 5-year US Treasuries at 3.5% versus short 5-year/5-year US rates at 3.30%. There are risks that longer-term rates in the US might have to stay higher than pre-Covid levels due to 1) inflationary echoes from the pandemic era and 2) larger budget deficits/bond supply dynamics.

Outlook

We believe the risk/reward in the short-dated investment-grade bond market today is compelling. Investing here allows cautious investors to share in one of the most attractive features of corporate bonds – their inflation-beating yields – while exposing their portfolios to just a fraction of the risk that would come with owning an all-maturity bond fund.

To be clear, however, that hasn’t always the case. Back in March 2021, we published an article – Short-dated Bonds: Past Perfect? – arguing that short-dated investment grade bonds were very much not the place you wanted to be at that time; three-and-a-half years ago, yields in this part of the market were so low that bondholders had no cushion to protect them when capital values fell. Investors were assuming a lot of risk but receiving precious little reward.

The situation has changed entirely since then. Yields are attractive and offer a useful cushion should there be any decline in capital values. That’s one reason why around 60% of the Artemis Short-Duration Strategic Bond Fund is currently invested in this part of the market.

At the same time, we would argue that making an all-in, inflexible allocation to investment-grade bonds would be unwise; as returns from our short-duration fund have shown, there are other ways to generate returns without taking too much risk, such as implementing relative value trades or curve trades in the government bond market or by adding selected exposure to carefully selected short-dated high-yield bonds.

Source: Lipper Limited/Artemis to 30 September 2024 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmarks: Markit iBoxx 1-5 year £ Collateralised & Corporates Index. An indicator of the performance of short-dated sterling denominated corporate investment grade bonds, in which the fund invests. It acts as a ‘target benchmark’ that the fund aims to outperform. Management of the fund is not restricted by this benchmark. While the fund has the flexibility to strategically invest across fixed income sectors, sterling denominated investment grade corporate bonds are likely to be the main asset class in the portfolio, and the manager believes this index is the closest proxy for the long-term asset allocation of the fund.