The area of the market where ETFs don’t make any sense

Jack Holmes says that many of the assumptions that investors take for granted when using ETFs don’t apply when it comes to high-yield bonds.

As an active manager operating in high-yield, you may assume it is in my interest to pour scorn on high-yield ETFs. And you would be right. After all, every pound or dollar that goes into a high-yield ETF is a pound or dollar that isn’t going into an active high-yield fund, like the one I’m paid to manage.

But there are other assumptions you may automatically make about the ETFs operating in this area of the market that couldn’t be further from the truth.

Yes, it is in my interests to tell you why these assumptions are wrong. But by the time you finish this article, I think you’ll agree it was in your interests to read about them, too.

Active doesn’t mean expensive

Costs compound in a similar way to returns, only they have a negative impact on your investments rather than a positive one. Therefore, it makes sense to keep these as low as possible, and the first assumption you are likely to make about high-yield ETFs is that they can significantly reduce costs in the same way they do in other classes.

However, a quick look at the figures shows this is not the case. The largest US high-yield ETF charges 49bps1. The largest global high-yield ETF charges 50bps2.

Yet the founder share class for our Artemis Funds (Lux) – Global High Yield Bond Fund is still available with ongoing charges of just 40bps.

Informational advantage

Another assumption underpinning the use of ETFs and other passive vehicles is that every active investor has access to the same information, so it is impossible for one to gain a sustainable advantage over another.

Again, we think this assumption – called the efficient market hypothesis – is wide of the mark, and not because we are implying that some high-yield investors have an informational advantage that only a Gordon Gekko-level of insider trading could deliver. Instead, we are making a claim that sounds even more far-fetched: all the information is available to all investors, but most make a conscious decision to ignore it. And we think we can prove it.

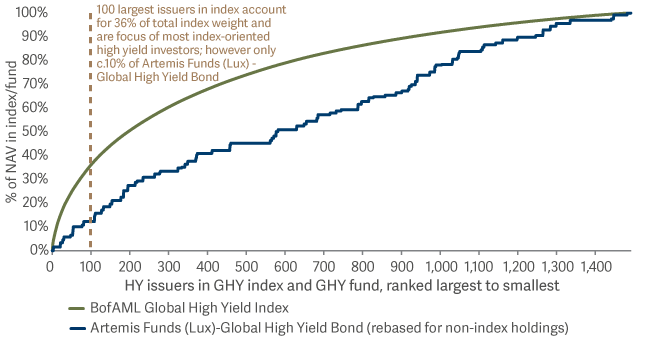

Here, let’s take a step back and look at the entire global high-yield universe. This is a market made up of about 1,500 companies that have collectively issued debt worth more than $2trn3. Yet of those 1,500 companies, just 200 account for about half the index by weight4.

Focusing on the under-covered, inefficiently priced tail

Most high-yield funds will focus only on this area of the market, either because of their large size or because they are index-led.

This means that outside the 200 largest companies in the global high-yield index, a lack of coverage makes the rest of the market completely inefficient.

Outside the 200 largest companies in the global high-yield index, a lack of coverage makes the rest of the market completely inefficient.

Outside the 200 largest companies in the global high-yield index, a lack of coverage makes the rest of the market completely inefficient.

Case study

How inefficient? As an example, let’s look at a 6.5% 10-year October 2025 bond issued by Australian mining contractor, Perenti, which makes up just 2bps, or 0.02%, of the index.

For much of the second half of 2023, the bond was trading slightly below par, at $98.5, meaning its yield-to-worst stood at 7.41%5.

But in August 2023, Perenti’s chief financial officer announced to investors: “Our US dollar high-yield bonds mature in October of 2025, and thus we’ll be looking to refinance prior to them going current, in October of 2024.”

In this early-call scenario (in which the bond would be called at 100 in October 2024 rather than October 2025), investors could now expect a yield-to-call of 8.55%6.

And what happened to the price of those bonds after the announcement? Absolutely nothing. Yes, you read that right. Absolutely nothing

What would be the equivalent in the equity market? A business announcing it had stumbled on cash reserves big enough to both pay down a significant amount of debt and boost its dividend yield by a full percentage point? What do you think traders would do? Shrug and say, “nothing to see here – I’m not interested in additional cash for no additional effort ”. Of course they wouldn’t! But this is the case in global high yield, where – if you believe the efficient market hypothesis – all available information is automatically reflected in bond prices.

Same bonds, different yields

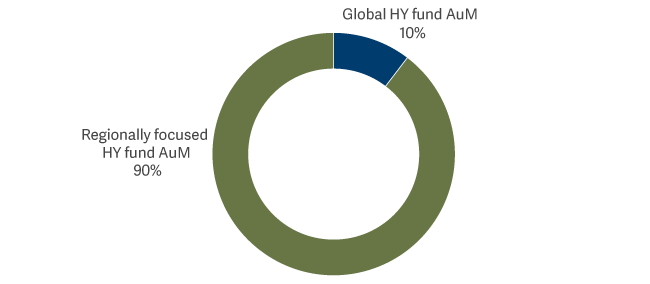

This is not the only way in which active investors are making a conscious decision to ignore all the information available to them. About 90% of the assets in high-yield funds are in those that focus on a single region (mainly the US)7.

As a result, they are overlooking a quirk whereby an international company can issue two bonds from the same part of the capital structure and with the same maturity, but that offer different yields depending upon which country they are issued in.

Taking advantage of this mispricing doesn’t involve taking a macro view on the direction of currencies – you can hedge this. But even after incurring this cost, it has been possible to earn up to 3 percentage points more over the past two years by lending to certain companies in euros rather than dollars (and vice versa)8.

Regional segmentation of market create inefficiencies

The vast majority of high yield AuM is in funds with a regional approach

Which leads to inefficient pricing opportunities for truly global investors

Once again – this is a market that we are supposed to believe is efficient.

The inefficiencies are only getting worse

To us, such enormous discrepancies would imply this is an area where there is a clear case for active management. Yet data from Coalition Greenwich shows the ETF-to-cash ratio (calculated by dividing the average daily notional volume traded in the listed ETFs by the average daily notional volume traded in the market) for high-yield bonds rose from 23.3% in 2019 to 47.4% in 2022.

What I am trying to warn against is taking a broad-brush, one-size-fits-all approach to financial markets and asset classes.

What I am trying to warn against is taking a broad-brush, one-size-fits-all approach to financial markets and asset classes.

In layman’s terms, this means close to half of all high-yield bond trades by value are not made by active investors, but by passive ETFs – and this has doubled from just three years ago. With ETFs mainly focused on the largest index weights – those 200 largest issuers I mentioned earlier – this means the enormous inefficiencies we have highlighted outside of this segment are rapidly getting worse.

I am not trying to tell you that active investing is good and passive is bad. What I am trying to warn against is taking a broad-brush, one-size-fits-all approach to financial markets and asset classes , many of which will have specific quirks and advantages that will be missed if you simply try to replicate the index.

Assumption was once said to be “the mother of all mistakes”. But we think another aphorism is just as useful for high-yield investors – “the devil is in the detail”. Because focusing on the detail is what allows you to outperform.

2https://www.blackrock.com/uk/individual/products/251814/ishares-global-high-yield-corp-bond-ucits-etf

3BofAML/Bloomberg

4BofAML/Bloomberg

5Perenti

6Perenti

7Bloomberg as at 31 January 2021

8Bloomberg, Artemis as at 31 December 2023