How the government can save the AIM market

Moving from the Alternative Investment Market to a full listing is too expensive, too distracting and takes too long. This needs to change, writes Mark Niznik.

The government is still looking at options for reforming ISAs to better support UK equity markets. But there are other things that can be done to revive UK equity markets and particularly AIM.

AIM – the Alternative Investment Market – plays an often unrecognised but vital role in the health of the UK economy. For the past 30 years it has been helping raise growth finance for what should be Britain’s most promising smaller companies.

It has also played a useful role for advisers seeking ways to mitigate client IHT liabilities. Numerous tax breaks (for example, business property relief from inheritance tax and stamp duty) have been made available to incentivise investment into businesses on AIM over the years.

AIM feels like a sinking ship

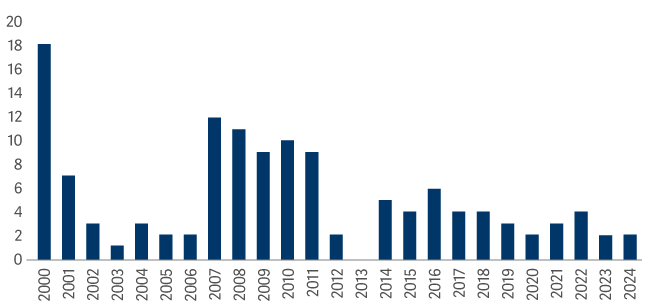

But at the moment, AIM feels like a sinking ship. Last year, 15 companies were admitted to the index1. Another 79 quit2. They were bought out, folded or went private, but the impact was the same: the market shrank. Today there are just 685 companies on AIM3 – the lowest figure since 2001.

Turning the tide has to be a priority for a government that needs to get Britain growing again. Something more is needed.

One simple measure for revitalising AIM would be to make it easier for companies to leave it – and to encourage them to do so. This may seem a strange argument but hear me out!

As companies mature, moving to the main market would seem like the natural evolution. This should be celebrated as a success for AIM, rather than seen as evidence of its shortcomings.

Obstacles to a full listing

Unfortunately, far too few companies make the step-up – it is too expensive, too distracting and takes too long. A full listing costs between £2 and £3 million in legal, advisory and other fees4. This does not account for internal resources, with senior management diverted from running and growing the business to focus on a procedure that typically takes six months or more.

Companies moving from AIM to the main market

We propose simplifying the move from AIM to the main market, via the following steps:

- Remove the requirement for a working capital report, prospectus and financial position and prospects procedure (FPPP) for companies that have been listed on AIM for three years and have produced three sets of fully audited annual accounts.

- Replace these with a gap analysis on any governance shortcomings, with the board self-certifying that the business meets main-market standards. The Quoted Companies Alliance Code and UK Corporate Governance Code have become more aligned over the past few years, so for most companies, this will not be a great leap.

- Reduce the timeline for the step-up from AIM to the main market from months to weeks. This process should not inhibit dynamic, entrepreneurial companies.

An even more radical approach we have seen proposed is to automatically move any company that has reached a certain market capitalisation – say, £500 million – and reported consistent profits for a certain period – say, three years in a row – from AIM to the main market.

What advantages would this bring?

For the company, a full listing provides access to a larger pool of capital and liquidity and can enhance the reputation of the business among global investors and customers. Inclusion in the FTSE All-Share index will drive inflows from passive funds, offsetting any money removed for IHT reasons.

For the UK, it would help to replenish a shrinking pool of fully listed companies. The AIM All-Share has an aggregate market cap of approximately £70 billion. Many of its members are established, profitable and cash-generative companies that would be well suited to the main market. Far better for them to have a full listing than succumb to takeover approaches at often disappointing valuations.

It would also tighten the focus of AIM tax breaks on the earlier-stage growth companies for which they were originally intended. This would make the allowance more defendable, which would be positive for the IHT funds that rely on them.

AIM should not be a final destination

AIM should be a stepping stone on the path to a successful future – not a final destination. Alpha Group, one of our fund’s largest holdings, is a prime example. It floated on AIM in 2017 at £1.96 before moving to the main market last year. It is currently trading at about £26.

If the current government is serious about reinvigorating the UK’s public markets, one first simple step would be to make it easier for other AIM-listed stocks to follow Alpha’s path. Refraining from a root-and-branch overhaul may not make too many headlines, but sometimes the boldest changes are the smallest ones.

If these proposed measures were implemented, AIM would shrink further initially, but its role would be clearer, and more companies would be encouraged to list on it as part of a logical and incremental progression towards a move up to the main markets, where there is more demand from investors.

It might save some from being taken private. Importantly, too, investors would be more inclined to support it knowing that a main market listing would happen more naturally, potentially lifting returns further.