How to invest if you really want to ‘buy British’

The FTSE 100 may be our flagship stock market, but it offers relatively little exposure to the domestic economy. If you really want to push up your exposure to the UK, William Tamworth recommends looking down.

When people think about the UK stock market, they usually think of the FTSE 100. The index is made up of the 100 largest companies listed in the UK and its movements are quoted every night on the evening news and on the homepage of The Financial Times.

Yet despite its status as the UK’s flagship stock market, its fortunes have little to do with those of its home country. The international nature of most FTSE 100 companies means they derive a very small proportion of revenues from the UK: less than 20%, in fact1.

So what should investors do if they really want to ‘buy British?’ Well, if you want to push up your exposure to the UK economy, we would recommend looking down.

British sales, British jobs, British taxes

Market capitalisation refers to the total value of a company’s shares in issue. Although the size of a company falls as you go down the market cap scale, the exposure to the domestic economy tends to increase.

For example, our portfolio of small, listed companies derives more than 60% of revenues from the UK2. Many of our holdings are large UK employers, such as pub company JD Wetherspoon (42,000 UK employees3), government outsourcer Serco (30,000 UK employees4) and food producer Bakkavor (14,000 UK employees5).

They also make a significant contribution to tax receipts: as detailed in JD Wetherspoon’s annual report, it contributed £780.2 million in tax in 2024 and £6.1 billion over the last decade.

Creating a ‘growth loop’

Most UK investors will be tired of hearing the valuation argument for buying UK small caps (UK equities are cheap and UK-listed small caps potentially even cheaper). But is there an altruistic argument for buying them, too? Could increased investment in UK-listed smaller companies help accelerate growth and create a virtuous circle that attracts further investment? We think so.

Whilst the United States has been blessed by a prevailing narrative of ‘American exceptionalism’, the UK has attracted much less flattering labels, perhaps summed up as ‘British declinism’. Labels are often misleading (more of which later) but it's unarguable that UK small caps have suffered a decade of fund outflows.

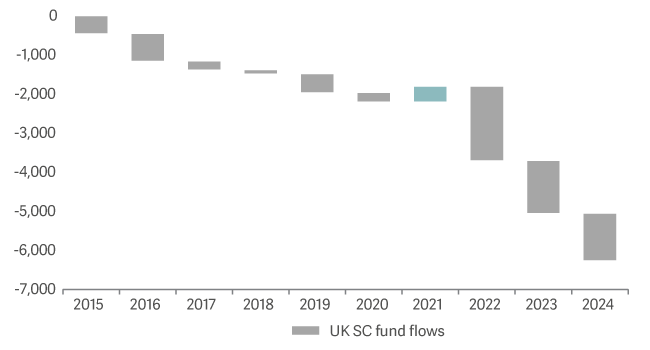

UK Smaller Companies sector net fund flows (£m)

Negative fund flows can create a vicious circle. Companies face the consequences of a higher cost of capital and therefore invest less, which affects growth, productivity and employment prospects. This in turn affects confidence. What can be done?

If domestic investors – whether it be pension funds, ISA holders or institutions – can be persuaded to invest in UK small caps, we could see a virtuous circle or ‘growth loop’. Increased investment. Faster growth. Rising confidence. Further fund inflows.

How does this work? Fund inflows reduce companies’ cost of capital as their share prices rise. A lower cost of capital reduces the required-rate-of-return hurdle that companies must exceed to justify investment. Higher investment boosts productivity and UK growth. Critically, investors who are early would also be handsomely rewarded through strong equity returns as share prices re-rate upwards.

A role for policy?

There is an argument for government intervention. Whilst there would be plenty of legitimate opposition to encouraging (or even mandating) increased allocation to UK equities, there are two important counterpoints:

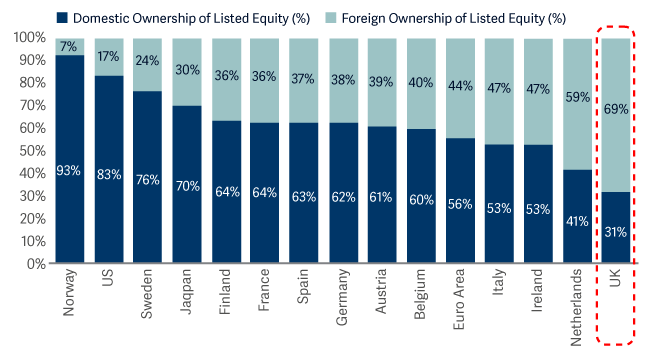

1. The UK’s domestic ownership of its listed equity market is unusually low.

Domestic and foreign ownership of listed equity (%)

2. The cost of pension and ISA tax relief is substantial: £49 billion per annum for pensions and £9 billion per annum for ISAs. The government is right to be asking whether it is getting sufficiently good value for money from these tax breaks.

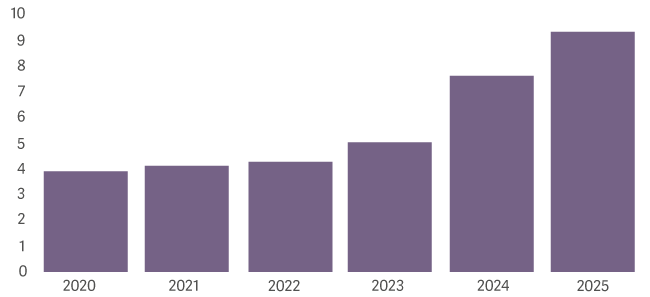

Estimated gross and net pension income tax and NIC relief, 2019 to 2020 to 2022 to 2023, £ billions.

ISA tax relief

Fundamentals are not broken

Despite the ‘British declinism’ label, the negative narrative that surrounds the UK is not supported by fundamentals.

UK consumers have been reducing debt-to-income levels for 17 years, unemployment is low, savings rates are high and real incomes are rising6.

Businesses have strong balance sheets – for companies that we hold in the fund, the median company is forecast to have no net debt next year.

The UK has a (relatively) centrist government that is likely to be in place until 2029, making it look remarkably stable compared with many other countries. In addition, we are now starting to see the government back up its growth rhetoric with action, especially in the fields of planning and regulation.

What is missing is confidence – and confidence can change quickly. The situation only needs to be ‘less bad’ for confidence to inflect and the growth loop to begin.

Compellingly selfish reasons to invest in the UK

There is indeed an altruistic rationale for investing in UK small caps – but also a compellingly selfish one: the prospect of strong, risk-adjusted returns from a segment trading well below intrinsic value. Britain isn’t broken. We think you should buy it.

2Artemis

3https://www.jdwetherspoon.com/about-us/people/ as at 30/04/2025

4https://www.serco.com/uk/careers/graduates/what-serco-can-offer-you as at 30/04/2025

5https://jobs.bakkavor.com/content/About-Us/?locale=en_GB as at 30/04/2025

6Lazarus Economics/ONS to 30/04/2025