Five reasons to rotate into global small-caps

Global small-cap stocks are under-owned and undervalued relative to large-caps and they also offer ample diversification for investors.

In an era where global equity portfolios have become overwhelmingly concentrated in expensive US large-caps and technology stocks, investors have been overlooking an asset class that provides ample diversification and could be on the cusp of a recovery. Global small-cap stocks are under-owned and undervalued relative to large-caps and they also offer a differentiated return stream.

Since the turn of the century and during longer time periods, small-caps have delivered higher returns than large-caps but in recent years, the small-cap premium has waned. Periods when small-caps beat larger companies and vice versa tend to come in cycles, so if we let history be our guide, the small-cap premium is due to make a comeback.

For all these reasons, we would argue that investors whose global equity allocations are skewed towards large-caps should at least consider adding smaller companies into the mix.

1. Valuations

An obvious reason to look at small-caps now is their attractive valuations, which offer an advantageous entry point and less downside risk than other stock markets bumping up against all-time highs.

Relative underperformance in recent years and investor outflows have pushed down the valuations of small-caps but there are other factors at play. Fewer analysts cover smaller companies, which can lead to inefficient pricing and bargains for discerning, well-informed investors. Smaller companies are less liquid than their larger counterparts, which also contributes towards mispricing.

Digging into the data, the forward price-to-earnings (P/E fwd) and price-to-book value (P/BV) of global small-cap indices make the asset class look like a bargain compared to large-caps across developed and emerging markets, not to mention the higher dividend yields (div yld) on offer, as the table below shows.

Small-cap valuations also look cheap today relative to their own history across the US, Europe and the UK.

Fundamental valuation measures

The picture is not cut and dry, however, given that global small-caps have higher trailing P/E ratios. This is partly due to their earnings having been relatively depressed compared to large-caps of late, but we are optimistic that this will change, particularly for our portfolio of companies. Valuations for global small-caps also hide disparities between regions; higher multiples in the US are pulling up the global numbers.

2. Faster growth

Valuations alone are not reason enough to buy something; assets can stay cheap for a long time. To avoid ‘value traps’, our SmartGARP® proprietary stock screening tool identifies companies that are not just cheap but are growing and delivering positive news, such as upgrades to profit forecasts.

A focus on companies that are both cheap and growing is particularly well suited to small-caps, which have the potential to grow their earnings and dividends faster than larger companies because they are doing so from a lower base.

Smaller companies also possess innate advantages such as an entrepreneurial culture, nimble organisational structure and flexibility, enabling them to thrive in new growth areas, such as artificial intelligence and renewable energy.

3. The return of the small-cap premium

Faster growth is often cited as the rationale behind the small-cap premium. This century, global small-caps have outperformed large-caps by an average of 2.3% per annum, according to Deutsche Numis1, although this disguises huge variations between years. In the past decade, however, large-caps have had the upper hand.

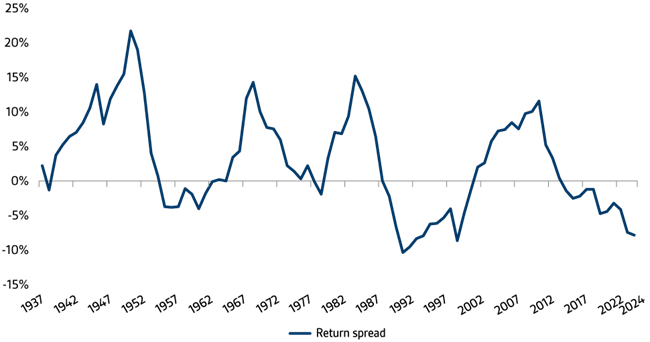

Peaks and troughs: Spread of returns between US small and large-caps

Admittedly, there are some structural reasons why small-caps have underperformed, including the growth of venture capital and private equity investing and the increasing regulatory burden that listed businesses face. But a lot of the challenges have been cyclical, driven by the rise in interest rates and the more economically sensitive sector composition of small-cap indices.

On the other hand, global small-caps enjoyed a particularly strong run between October 2001 and October 2007. Large-caps had outperformed during the late 1990s so small-caps were coming from a place of being undervalued and under-owned – similar, in fact, to where they are today.

If history repeats itself, we believe the next few years could be a rewarding time for small-cap investors.

The small-cap rally, Oct 2001 to Oct 2007

While small-caps have certainly been more volatile than their larger counterparts over time, they have captured much more of the upside (173.6%) and no more of the downside (100.3%) of large-caps, with a meaningfully lower maximum drawdown (-39% versus -43%) over the past 25 years2.

4. Diversification

Global large-cap benchmarks have become extremely concentrated in both US equities and the technology sector. The MSCI ACWI has almost two-thirds (64.6%) in the US3, whereas the MSCI ACWI Small Cap index is equally split between the US (52.3%) and international markets4.

The sector spread within small-caps also looks more even-handed. Industrials account for 20.1% and financials for 15%, while information technology and consumer discretionary stocks comprise 12.3% apiece5.

In contrast, the MSCI ACWI has more than a quarter (26.1%)6 in information technology, in addition to large positions in ‘Magnificent Seven’ stocks that are correlated to tech trends but housed within different sectors (Amazon and Tesla are classed as consumer discretionary stocks, while Meta Platforms and Alphabet sit in the consumer services sector.)

The MSCI ACWI’s top 10 stocks absorb almost a quarter (23.6%) of its exposure, whereas the MSCI ACWI Small Cap index has just 1.9% in its top 10 and more than double the number of constituents (5,810 versus 2,509)7.

There is huge dispersion within the small-cap universe in terms of valuation, growth potential, revenue drivers and performance outcomes. This creates ample opportunities for stock selection. The weighted-average market capitalisation of companies within the MSCI ACWI Small Cap index is $1.9bn, with the largest constituent weighing in with a market cap of $26bn8 – bigger than many FTSE 100 companies.

5. Macroeconomic tailwinds

After a decade of large-cap dominance, macroeconomic conditions are starting to provide a more conducive backdrop. Smaller companies tend to fare better when interest rates are on a downward trajectory because they have a higher proportion of floating-rate and short-term debt – and more debt in general relative to their earnings – than larger companies.

Small businesses often focus on a specific niche. Their specialism gives them pricing power, which is especially helpful in an era of structurally higher inflation because they can pass cost increases onto customers.

Furthermore, the rise of protectionism and nationalism could favour companies with local customers and supply chains over and above multinationals.

All that said, small-caps are not without risks. They are less liquid and more volatile than large-caps and have smaller balance sheets for investing in research and development, or coping with macroeconomic uncertainty. Yet we believe many of these risks are already priced in and can be mitigated through careful stock selection and portfolio construction.

We would also argue that an allocation to small-caps can help balance out the risks within an overall portfolio by introducing a good amount of diversification and in our view, this appears to be a timely entry point.

2Source: Artemis, MSCI, data from 31 Dec 2000 to 31 Aug 2025

3Source: MSCI as at 29 Aug 2025

4Source: MSCI as at 29 Aug 2025

5Source: MSCI as at 29 Aug 2025

6Source: MSCI as at 29 Aug 2025

7Source: MSCI as at 29 Aug 2025

8Source: MSCI as at 29 Aug 2025