It’s compounding, but not as we know it

Fund manager Mark Niznik says the number of UK smaller companies buying back their own shares demonstrates the value in this area of the market.

Management teams across the UK are so fed up with the lack of demand for their companies’ shares that they are using profits to buy them themselves. ‘Share buybacks’, as they are called, have rarely – if ever – happened at such a rate. And it is not just the FTSE 100 giants snapping up their own bargain shares. Small companies are now getting in on the act.

Thirty companies on the FTSE All-Share index saw their number of shares fall by 5% or more in 2023 – largely as a result of share buybacks1. Over three years, 27 companies have bought back 10% or more of their shares2. Last year, around one in eight listed UK smaller companies bought back shares3.

Within our own smaller companies strategy, 11 companies bought back their own shares in 2023. I have been managing money in small caps for 30 years and have never seen anything like this.

So why is it happening? What does it tell us about the UK market? And is it good or bad for investors?

Understanding buybacks

A company has a number of choices about what it does with its profits. It can reinvest for future growth, which includes mergers and acquisitions (M&A); it can distribute the cash to investors in the form of dividends; or it can buy back its shares.

In theory, an investor should be no worse off whether the company issues dividends or buys back shares. If the number of shares in circulation decreases and the value of the company remains the same – as it should – the share price should rise.

Some shareholders say it is better to have the money as a dividend. I disagree. In my view, investors should think in terms of total return – income and capital growth.

If you want the extra income, you can sell some of the shares. This can work out as more tax-efficient for many investors as income is typically taxed at a higher rate than capital gains (but check with an expert before making any decisions).

Buybacks are sometimes criticised as being a sleight-of-hand way of rewarding management, who are often rewarded on the basis of the earnings per share (EPS – the calculation of the profits of a company that are attributable to each share in that company. EPS is calculated by dividing the profits of a company after tax by the number of shares in issue).

If a company buys back shares, those earnings per share automatically rise. If they pay a dividend, they do not. This can inflate management pay and bonuses.

In addition, some companies (wrongly, in our view) pay management in part with new shares and then exclude the cost of this from their underlying EPS figures, which can artificially flatter earnings and negate the benefit of buying back shares. So we have to be alert.

The other problem with share buybacks is that companies that make a virtue of doing this may do so when the price is high. Buying back shares at an elevated price benefits selling shareholders but is to the detriment of long-term holders.

We are perfectly comfortable seeing UK companies buying back their shares when they are as cheap as they are today. Our focus is on identifying companies with a high return on capital that generate lots of cash. These traits give companies multiple different options.

If buybacks receive mixed views, what does the data suggest? Research shows that since 2016, the top 20% of FTSE SmallCap companies by buyback yield3 – in other words, those spending the most on buybacks as a proportion of their market capitalisation – have delivered around twice the total return of the whole index4.

Smaller companies are especially cheap – even though smaller companies have historically outperformed their larger counterparts by a massive margin.

Market view

So what does this all tell us about the UK today? Everyone knows that the UK is cheap relative to the rest of the world. A common measure of value is the ratio of a company’s share price to its earnings. This multiple is almost as low as it was in 2008/9 and similar to its level in the Covid anxiety in 2020.

Smaller companies are especially cheap – even though smaller companies have historically outperformed their larger counterparts by a massive margin.

Data from Numis shows that if someone invested £1,000 for a new-born baby in UK small caps in 1955 and reinvested dividends, by the time the baby had grown up and retired in 2022 – aged 67 – this amount would have grown to £9m.

The same amount invested in UK larger companies over the same period would also have multiplied your wealth – but to just £1m. Smaller companies have the potential to deliver strong returns in fits and starts, but over the long term they could make a powerful difference to an investor’s portfolio.

The assumption in the rest of the world is that the UK is struggling and that smaller companies face an especially tough time. This is just not what we are seeing in meetings with most of the companies we own or are interested in.

No one knows these companies as well as the people running them and if they think their shares are cheap, then buying them back is a vote of confidence in the business.

This buyback activity should be a reminder that not all smaller companies are heavily indebted. Lots are generating excess cash.

If the UK market recovers, it could bounce back sharply, like a coiled spring unwinding. We believe buybacks are a signal of the value building in UK stocks and should be embraced.

However, please bear in mind that all financial investments involve taking risk and the value of your investment may go down as well as up. In addition, the past performance of stockmarkets is not a guide to their future performance.

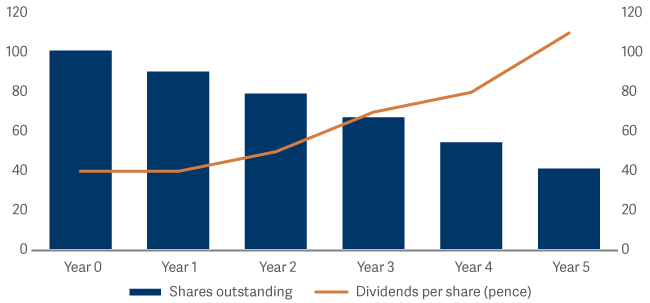

How share buybacks can deliver returns to patient shareholders: A worked example

‘Good Co’ is an imaginary company with 100 shares in issue and £100 of net income. So it generates £1 of earnings per share. With reinvestment largely going through its P&L (profit and loss), Good Co pays out 40% of its net income in dividends and 60% in share buybacks. It grows its net income at 6% per annum.

Despite reinvesting to ensure that its future is sustainable, Good Co is unpopular with investors: it trades at a P/E multiple (price-to-earnings, a measure of valuation calculated by dividing the market value price per share by the company’s earnings per share) multiple of just 6x, giving a share price of £6 and a total market cap of £600.

Good Co’s low starting valuation means that, in Year 1, £64 of share buybacks reduce its share count by 11%. Thereafter, as it directs 60% of its net income to share buybacks each year, an unusual form of reverse compounding occurs:

- In Year 2, buybacks reduce Good Co’s share count by 13%;

- In Year 3, its share count shrinks by another 15%;

- In Year 4, its share count shrinks by 19%;

- In Year 5, 25% of its shares are

However, please bear in mind that all financial investments involve taking risk and the value of your investment may go down as well as up. In addition, the past performance of stockmarkets is not a guide to their future performance.

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total | |

| Shares outstanding | 100 | 89 | 78 | 66 | 54 | 40 | Down 59.75% |

| Dividends per share (£) | 0.4 | 0.4 | 0.5 | 0.7 | 0.8 | 1.1 | Up 185% |

By the end of this process, Good Co’s share count is 60% lower and its dividend per share has increased by 185%. For its patient shareholders, that means that what started as a generous 7% dividend yield has compounded to 19%...

If it keeps going, Good Co will have reverse-compounded its way to the ‘golden share’ – the last remaining share in the company – within eight years.

“This cannot happen!”, I hear you shout. “Surely, Good Co’s share price must adjust upwards to reflect the fall in the number of shares in issue!” And we agree… in theory. But this highlights the most perplexing aspect of these share buybacks, which is how little impact they are having on share prices. If cashflows per share rise year-in, year-out, then surely share prices should too?

Yet in the case of the large brigade of UK companies that have been buying back shares, prices have not been adjusting. That means, illogically, that companies are able to eat into their equity bases with even greater alacrity.