Artemis Corporate Bond Fund update

Stephen Snowden and Grace Le of the Artemis Corporate Bond Fund report on the fund over the quarter to 30 September 2024.

Source for all information: Artemis as at 30 September 2024, unless otherwise stated.

Fund objective

The fund aims to generate a return greater than the iBoxx GBP Collateralized & Corporates Index, after fees, over rolling three-year periods. It seeks to do this through a combination of income and capital growth.

Performance

For full five-year discrete performance, please see below. Please remember that past performance is not a guide to the future.

The third quarter passed without too much drama and brought a gradual move lower in bond yields (the annual returns investors earn from bonds, expressed as a percentage of their current market price). With a return of 2.6%, the fund added another tranche of outperformance relative to its iBoxx £ Collateralized & Corporates index1 benchmark and its second benchmark, the IA Sterling Corporate Bond sector2. Good credit selection in the financials and real estate sectors was key to its performance.

| Discrete performance, 12 months to 30 September |

2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Artemis Corporate Bond Fund | 12.5% | 7.5% | -20.3% | 3.8% | N/A |

| Markit iBoxx Sterling Collzd & Cor (UK Midday) TR | 11.0% | 7.6% | -24.1% | 0.1% | N/A |

| IA £ Corporate Bond NR | 11.1% | 7.1% | -20.8% | 1.2% | N/A |

Source: Lipper to 30 September 2024 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

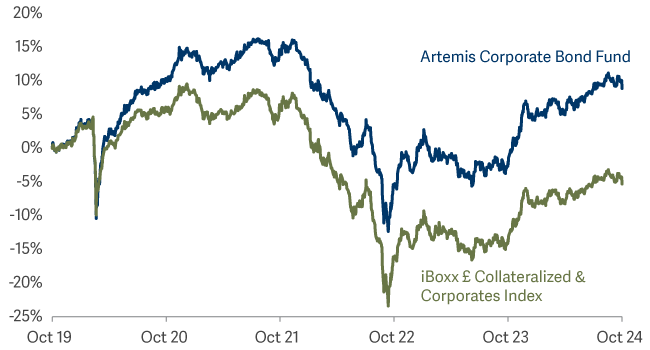

Performance since launch

Source: Artemis, IHS Markit, class I accumulation shares in GBP from the launch date 30 October 2019 to 30 September 2024. All figures show total returns with dividends and/or income reinvested, net of all charges. Performance does not take account of any costs incurred when investors buy or sell the fund.

A challenging quarter for water companies – and German car manufacturers

In part, the water sector’s poor performance over the quarter was due to cheap new issues from Welsh Water, Anglian Water and Yorkshire Water. The pattern we saw was a familiar one. The sector sold off as new deals were announced as pricing readjusted to reflect the wider spreads (the difference in yields between a bond and a US Treasury [government bond] of the same maturity) at which the issuance was being offered. The sector then stabilised and spreads recovered somewhat, with the newly issued bonds tending to outperform in the recovery.

Our policy over the last two years has been to run with relatively modest exposure to the water sector but to buy into (cheap) new issues, then hold them briefly before selling them for a profit. Eventually, it will be time to buy and hold water-company bonds – but we are not there yet. The water sector can be an easy target for a government which is already unpopular with voters. So it may still be too soon to add to our holdings in the sector.

It was also a challenging quarter for German car manufacturers, to which the fund had zero exposure. Given that all three major brands (BMW, VW and Mercedes) have now warned on profits, that was helpful. We should not overstate the weakness, however.

Activity

New issuance was sparse through July and August, but picked up in earnest in September. The fund bought into several of these new issues. At the end of the quarter, we still held newly issued bonds from:

- Anglian Water Services

- Comcast

- CPI Property Group

- East of Japan Railway

- Dwr Cymru Financing

- Great Portland Estates

- Haleon

- ING Group

- Land Securities

- MassMutual Global

- Nordea Bank

- Pearson

Meanwhile, we made a number of switches between different bonds from the same issuer. These switches included Centrica, CPI Property Group, EDF, ING Group, Land Securities, Motability, Rothesay and across the UK water companies.

We sold our holding in Bayer in September. Its legal problems, which largely arose from its disastrous acquisition of Monsanto, have ebbed and flowed over the years. Of late, the judgments have been in Bayer’s favour and its bonds have performed well. But we are conscious that Robert F. Kennedy Jr (RFK), who has been at the forefront of pursing Bayer for damages, has joined Donald Trump’s team. While the result of the election is too close to call, a Trump victory would likely be an incremental negative for Bayer.

We sold the fund’s remaining exposure to French banks. The political situation in France is clearly not helpful for the country’s perennial deficit problems and French government bonds have weakened in sympathy. In our view, French corporate bonds have proved to be immune to the weakness in the sovereign market thus far. It seems prudent to move on in case that doesn’t last.

Outlook

In our view, the prospects for corporate bonds look good heading into the year end. The main challenge to the optimistic view on corporate bonds is that they no longer appear to be cheap in outright terms or relative to government bonds. Equally, however, they are not – in our view – overly expensive. Most obviously, their yields are still healthy. That matters – especially when interest rates are being cut.

The balance between supply and demand in the corporate bond market, meanwhile, appears to be supportive. Despite a surge in new issuance in September, the premium that corporate borrowers must pay over and above the yield on government bonds increased only slightly over the quarter.

Most central banks are cutting interest rates (albeit not at a uniform pace) and markets typically respond well to that. We can debate the incremental effectiveness of China’s stimulus measures, but it would appear to be positive in the near term. There are pockets of concern, but they aren’t new. While auto companies have been issuing profit warnings, the weakness was easy to predict. And while their borrowing costs have increased relative to other sectors, these companies are far from being in trouble. Weak car sales are a classic sign of consumer fragility – but airports and holiday resorts are full. Perhaps people are using the time by the pool to decide whether to make the leap to electric vehicles.

2A group of asset managers’ funds that invest in similar asset types to the fund, collated by the Investment Association. It acts as a ’comparator benchmark’ against which the fund’s performance can be compared. Management of the fund is not restricted by this benchmark.