Artemis Funds (Lux) – SmartGARP Global Emerging Markets Equity update

The manager reports on the fund over the quarter to 31 March 2025.

Source for all information: Artemis as at 31 March 2025, unless otherwise stated. The fund is actively managed. The fund's objective is to increase the value of shareholders’ investments primarily through capital growth.

Performance

- Q1 relative performance +1.4%. Fund +1.3% vs MSCI EM -0.1% (in sterling)

- Performance in top decile vs. IA GEM sector for 1,3,5 years and since launch (April 2015)

| Three months | Six months | One year | Three years | Since launch | |

|---|---|---|---|---|---|

| Artemis Funds (Lux) - SmartGARP Global Emerging Markets Equity Fund | 4.6% | -1.7% | 8.9% | 19.6% | 47.5% |

| MSCI EM NR USD | 2.9% | -5.3% | 8.1% | 4.4% | 26.1% |

| IA Global Emerging Markets NR | 2.1% | -5.3% | 5.3% | 2.6% | 22.5% |

Summary

- Emerging market stocks remain cheap and unloved, with abundant growth and income opportunities.

- Value bias in the fund remains substantial: the fund's P/E is at a 32% discount to MSCI EM, but with favourable quality and growth characteristics compared to the market.

Artemis SmartGARP Global Emerging Markets Equity Fund

If the fund were a stock

Key fund characteristics

Performance – protectionism dominates sentiment, China a bright spot.

Despite external risks increasing because of the US' protectionist trade policies, emerging markets performed better than others in the period. Overall, they outperformed developed markets by 4.7% and US stocks by 7.6% during the quarter. EM’s role as a return generating diversifier has been a disappointing one in the last decade, but this could be changing as US stocks face challenges. Unusually, this was also accompanied by a weaker dollar.

China appears to be on the cusp of a recovery. Economic indicators are picking up, including retail sales, manufacturing activity and other consumption measures. Meanwhile, property prices are showing some signs of stabilisation. This suggests stimulative measures are having an impact on the real economy. We believe this could boost returns in the equity market substantially.

Rather than focus on where the market is going, we take a dispassionate approach and look at the things that investors might have missed. There remains much to be excited about. Emerging markets' low valuations offer potential upside, particularly when sentiment changes. There are opportunities in both growth and income stocks.

Attribution – favourable tailwinds for our holdings

Historically, a weaker dollar has provided a good backdrop for emerging-market assets and Latin American markets in particular have tended to do well. Our holdings in Bancolombia, Banco do Brasil and Porto Seguro all benefited from this backdrop.

Many of our peers have chosen to avoid China, with some deeming it to be uninvestible. We disagree. We have no particular edge on calling the direction of markets. However, we have been convinced that the risk-reward ratio for some companies in China is among the best of all stocks globally. Despite our enthusiasm for the market proving negative from an asset allocation perspective, our stock picking has more than compensated for the risks taken in the last few years. Alibaba, JD.com, Geely and China Hongqiao were all among the fund's top contributors in the quarter.

Elsewhere, having less in semiconductors and more in financials and consumer stocks was a helpful support. These were offset by weakness in Wiwynn, Hon Hai and Yue Yuen, among others.

Activity – adding to Chinese consumer-related and reasonably valued Indian stocks

In the last few months, we have been adding to consumer-related stocks in China. Pessimism has reached extreme levels and with low investor positioning we felt the risk-reward ratio has become extremely favourable. There remains a clear disconnect between share prices and the financial performance of businesses in China.

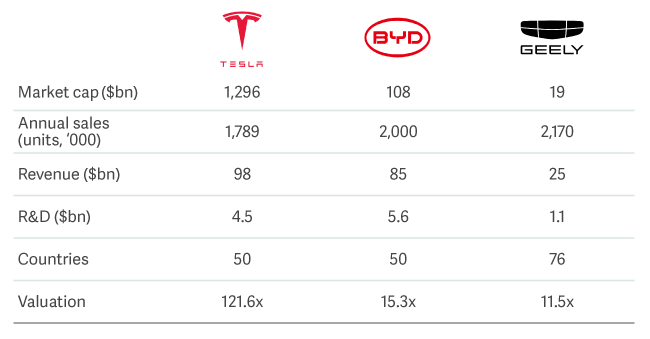

One example is electric vehicle manufacturer BYD, which we added at the start of the year. The table below shows it compared with Tesla (and Geely, another one we like). BYD manufactures more electric vehicles, spends more on R&D and generates about the same amount of revenue as Tesla, yet trades at a fraction of its market capitalisation and valuation. Many claim that Tesla is more than just a car company, but I would argue that BYD could be seen as the same in the future. In recent months, the company has announced an ultra-fast battery charge that takes about the same amount of time as filling up a car with petrol.

Rapid growth in China autos

We also added to People’s Insurance Group, Western Mining and JD.com. Elsewhere we added to our India exposure by topping up Redington (software) and Chambal Fertilisers. These were funded by sales of Hon Hai and Genius Electronic and reducing Emirates Bank. Fundamental deterioration in DB Insurance and Hana Financial also led to reductions in those positions.

The result of these changes is that the fund continues to offer an attractive combination of extremely low valuations and good growth prospects. Alongside our China overweight, in aggregate we remain overweight Brazil, Korea and UAE and underweight India, Taiwan and Saudi Arabia. At the sector level, financials, consumer discretionary and industrials feature as the largest overweights. Technology and consumer staples are the largest underweights.

We remain heavily biased towards value stocks

The fund offers a forward P/E of 7.4 vs. 10.9 for the index (a 32% discount). We think our discipline around valuations is likely to be a rewarding strategy for the years ahead. Whilst value stocks in EM have recovered from depressed levels in recent years, the gap in valuations between cheap and expensive stocks remains stretched. This suggests that there is still an opportunity. Typically, significant exposure to value stocks coincides with distressed balance sheets and volatile earnings. This does not appear to be the case today; the fund offers favourable quality and growth characteristics. For instance, the fund's net debt/EBITDA is low, and its free cash flow yield is much higher than the market's.

EM – pessimism well reflected in prices, weakness in US could present a shift in capital to cheaper markets

The Chinese economic recovery has so far been underwhelming. Geopolitics creates uncertainty. On the positive side, the potential for stimulus measures to offset a weaker growth outlook could be significant. EM stocks remain lowly valued and out of favour. This gives them some downside protection, compared to markets that have performed exceptionally well because growth has been extrapolated far out into the future. In the shorter term of course, any weakness in sentiment leads to selling of EM markets. Rather than become more pessimistic in these periods, we think a contrarian approach of allocating to the asset class will be a rewarding strategy.

When times are bad, risk aversion can lead to indiscriminate selling. We believe this creates opportunities for disciplined investors and our process has been designed to look for the companies where the fundamentals are signalling good news, yet share prices are not reflecting this optimism.

Tariff risks

Finally, a quick comment on tariffs. Although ‘Liberation Day’ occurred post quarter end we thought it worth providing a short thought. The extent of the tariffs announced (even after the pause) will likely impact economic growth and consumer confidence. The last few days have exposed the complacency around risks and the over optimism towards companies' earnings prospects. Given the uncertainty and risks to economic growth ahead, investors have chosen not to wait around to see how things play out. While some backtracking has already occurred, I suspect uncertainty around policy measures will hinder investment decisions and erode confidence further.

China has chosen to retaliate by enacting reciprocal tariffs against the US. The worry is that this turns into a 'tit for tat' battle that sends the global economy into a recession. Chinese stocks have delivered an annualised return of around 1% since the height of the financial crisis in 2008. A very disappointing outcome, but one that suggests that much bad news is already in share prices. We continue to see positive prospects from further stimulus measures, which are likely to be more important for China and Asian economies than the tariffs are.

It stands to reason that markets with self-sufficiency and stronger domestic consumption will be more insulated from trade worries. Complacency in markets and over valuation could present significant risks, we believe a margin of safety is preferred, which leads us to emerging markets and within it, a preference for China, Brazil, Korea and others.

Markets often fall sharply, yet over time they tend to deliver solid returns. While logic suggests adding to investments during downturns, human instinct typically does the opposite – pulling back after falls and piling in after rallies. Though academics have long advised against this behaviour, it is hard to override human nature. Our fund remains attractively valued relative to emerging markets, which are in turn reasonably valued compared with global markets.

The key lesson: invest in undervalued assets, reinvest during drawdowns, and let profits and dividends do their work. Tariffs may weigh on trade, but inflation is benign and rates likely stable. The main risk is earnings faltering, but SmartGARP has already tilted us toward more resilient, lower-risk holdings. So, despite market noise, our positioning looks well judged.

Fund 10-year discrete performance

| Calendar year performance |

2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Artemis Funds (Lux) – SmartGARP Global Emerging Markets Equity | 4.6% | 9.7% | 15.7% | -14.8% | 12.6% | 3.3% | 19.1% | - | - | - | - |

| MSCI EM (Emerging Markets) NR USD | 2.9% | 7.5% | 9.8% | -20.1% | -2.5% | 18.3% | 18.4% | - | - | - |

Source: Lipper Limited/Artemis to 31 March 2025 for class I Acc USD

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmark: MSCI Emerging Markets Index; the benchmark is a point of reference against which the performance of the fund may be measured. Management of the fund is not restricted by this benchmark. The deviation from the benchmark may be significant and the portfolio of the fund may at times bear little or no resemblance to its benchmark.