Consumer Duty

The Financial Conduct Authority introduced a new Consumer Duty (“the Duty”) on 31 July 2023. Its purpose is to raise standards of consumer protection across all areas of financial services and require firms to monitor customer outcomes throughout their products’ life cycles.

The Duty requires asset management firms such as Artemis to monitor ‘customer outcomes’ – the goals and objectives that customers have when investing in an investment fund – throughout the time they have a relationship with the firms.

At Artemis, our aim has always been to offer exemplary performance and client service, putting the interests of our customers first.

The rules and obligations

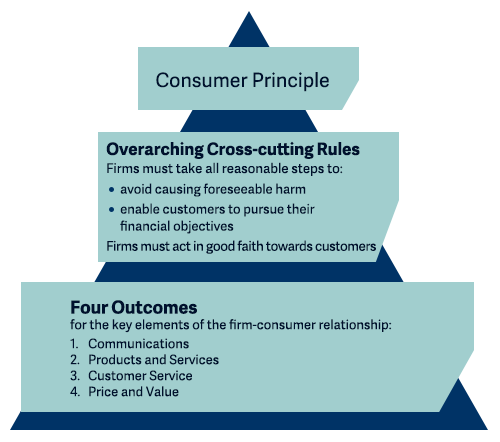

The Financial Conduct Authority (‘FCA’) introduced a new principle:

“A firm must act to deliver good outcomes for retail customers”

with three overarching cross-cutting obligations that apply across all of a firm's operations and activities:

- acting in good faith

- avoiding foreseeable harm

- enabling and supporting customers to pursue their financial objectives

The principle obligates firms to achieve good outcomes for clients in the following four areas:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

The Duty requires firms to consider the needs and objectives of retail customers, including those who display characteristics of vulnerability.

Under the Duty, firms should be open and honest, avoid harm and support their customers in pursuing their financial goals. This means retail customers should expect:

- Helpful and accessible customer support, so it’s as easy to sort out a problem or switch or cancel a product as it was to buy it in the first place.

- Timely and clear information retail customers can understand, allowing them to make good financial decisions. This means important information shouldn’t be buried in lengthy terms and conditions.

- Providers to offer products and services that are right for their customers, rather than pushing products and services they don’t need.

Products and services to provide fair value. This should mean investors won’t be ripped-off or have to pay costs they didn’t expect. It doesn’t mean they won’t have to shop around. - Firms to consider if customers may be in a vulnerable situation when dealing with them. This could be due to poor health or financial troubles, for instance.

- Where problems do arise, firms must have processes in place to resolve issues and complaints in a timely and proactive way.

As well as acting to deliver good customer outcomes, firms will need to provide evidence of how these outcomes are being met.

Scope

Artemis has conducted a review to determine which products and services are within the scope of the Duty. Products and services in scope are those where Artemis is part of the distribution chain to UK retail consumers and where we can determine or materially influence the outcome for those customers.

These Artemis funds are currently in scope of the Duty:

- Artemis’ range of unit trust funds

- Artemis’ range of OEIC funds

- Artemis’ range of SICAV funds

Artemis and the Duty

Customer Outcome Statements

Artemis has defined a series of Customer Outcome Statements that the firm will adhere to in order to be satisfied that it is treating customers fairly, managing conduct risks effectively and in the context of retail customers, meeting the requirements and expectations of the Consumer Duty. Where monitoring highlights areas of potential concern, appropriate actions are taken to resolve.

| Outcome | Statement |

|---|---|

| (1) Products and Services | Products and services are designed to meet the needs, characteristics, and objectives of customers and are appropriately distributed in line with the target market assessment. Products perform as customers have been led to expect. |

| (2) Price & Value | Customers are provided with products and services that provide fair value. There is a fair relationship between the price paid for Artemis’ products and services and the overall benefits customers receive. |

| (3) Customer understanding |

Customers receive communications they can understand which are fair, clear, and not misleading. They receive information that enables them to be confident they are making effective, timely and properly informed decisions. |

| (4) Customer Support | Customers, including those with characteristics of vulnerability, receive the support they need when they need it. They receive the level of service they have been led to expect and do not face unnecessary barriers in relation to investing, making changes to their investments, selling their investments, or making a complaint. This includes where Artemis services are provided using an outsourced arrangement. |

What information Artemis issues:

-

The European MiFID Template (EMT) is available through a range of data providers and also in the fund literature library here on our website.

-

Artemis also publishes annually, every April, its Assessment of Value report which assesses the overall ‘value for money’ of the range of unit trust and OEIC funds it manages.

-

We also publish value assessment conclusions for our range of SICAV funds and Artemis Alpha Trust plc via the EMT.

-

We provide information directly to investment professionals where requested.

What information Artemis expects to receive:

-

Distributor MI (in line with the Joint Trade Association Distributor Feedback Framework, September 2023). Whilst we are writing to all of our distributors directly on this matter, should you have any questions, please contact us at [email protected]

-

We welcome feedback from customers on any and all aspects of our products; the services provided; information about our funds and their strategies, performance and portfolios; fund commentaries, fund manager views and market updates; and about Artemis as a business.

For more information

We welcome enquiries and input from distributors and manufacturers. Please contact your usual Sales relationship manager or email [email protected].