Think Europe will always be out of favour? They used to say that about the US

Investing in the US market today may seem like a win/win situation, but Philip Wolstencroft of the Artemis SmartGARP European Equity Fund says that it wasn’t so long ago it could have been regarded as a long-term laggard. He explains why you shouldn’t ignore other regions just because they’ve had a difficult couple of years.

If someone asked you to picture what the US looked like in the 1970s, you might conjure up an image of John Travolta strutting about in flared trousers under the reflected light of a disco ball. But the reality for investors was a lot less glamorous.

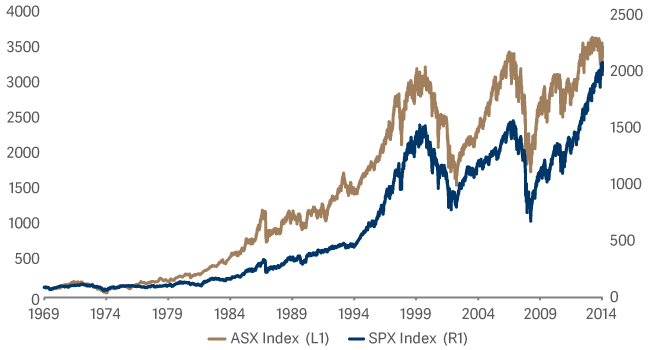

In the face of rampant inflation, the S&P 500 finished the decade barely above where it had started1. Aided by currency movements, the FTSE All Share overtook it in 1976 and it wasn’t until 2014 that the US market regained the lead2.

US inflation vs S&P 500 (rebased 100 = 15 Jan 1969)

Performance of S&P 500 vs FTSE All-Share 01/01/1970 – 31/12/2014

So while the US may look unassailable today, it wasn’t so long ago that it was a long-term laggard. The point is, things change, and you shouldn’t ignore areas such as the UK, Europe or emerging markets just because they’ve had a difficult couple of years. Especially when the threat from concentration risk is so high.

The importance of diversification

Today the US makes up more than 70% of the MSCI World index3. Just two companies, Apple and Microsoft, account for almost 10% of the total4. These are great companies and there is no reason why they can’t continue to go from strength to strength. But when we launched the Artemis SmartGARP European Equity Fund in 2001, many people thought the same about Nokia.

Back then, the telecoms giant was the dominant player in the mobile phone market and the biggest company in the European index5. Its phones weren’t just functional, they were iconic, with Keanu Reeves using a modified Nokia 8110 in 1999 blockbuster The Matrix. Apple was nowhere – almost literally, having narrowly escaped bankruptcy a few years earlier6. It wouldn’t launch its first mobile phone until 2007.

That year proved to be something of a turning point – not just for Apple, but Nokia as well. Nokia’s share of the smartphone market stood at 49.4% in 20077. By 2013, it was down to just 3%8.

We are not saying this is going to happen to Apple or Microsoft. The earnings prospects for both companies, as well as the other ‘Magnificent Seven’ stocks (Amazon, NVIDIA, Alphabet, Meta and Tesla), look solid. But that’s the least you should expect on an average price-to-earnings (P/E) ratio of about 299. At these valuations, they can’t afford to disappoint.

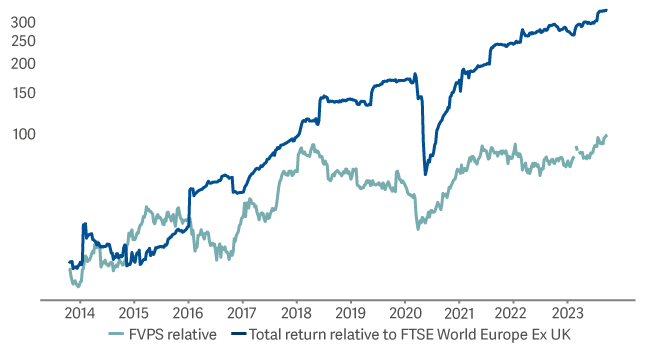

Growth at a reasonable price

In the Artemis SmartGARP European Equity Fund, we prefer to buy companies whose earnings are growing quickly, but that trade on valuations that provide a margin of safety if they fail to meet expectations.

This may sound like a contradiction – surely value stocks trade so cheaply because their growth prospects are limited? This would be the case if markets were efficient, as they are supposed to be.

But the reality is that investors like to extrapolate news flow, both good and bad. This means that when a poorly performing business manages to turn itself around, it can take a while for investors to catch up. And for a time, it will remain priced for disaster, even though earnings are growing faster than the market. This is the point where we like to invest.

One example today is Stellantis, which resulted from the merger of Fiat Chrysler and PSA (Peugeot S.A.). Everybody seems to hate auto stocks, but this is a business whose management team has a track record of cutting costs, increasing profits and generally looking after shareholders.

The strange thing is that if a tech stock such as Google or Amazon had Stellantis’ record of earnings growth, you’d say, ‘that’s why it’s on a P/E ratio of 40x’. Yet the automotive company is on a prospective P/E ratio of 410.

Stellantis

Note: Reference to specific stocks should not be taken as advice or a recommendation to invest in them.

Stellantis is not the only one. If our fund were a stock, it would have a return on capital of 8%11, which is less than the market, and a historic yield that is only slightly higher.

But where it starts to get exciting is the prospective earnings yield, which currently stands at 16.6%12. Such a high figure can mean that profits are about to be cut. Yet earnings forecasts for our portfolio holdings keep getting nudged up.

There is also a growing trend among our holdings to use earnings to buy back shares, meaning patient investors receive a growing cut of cashflows and dividends. This is one of the reasons why the yield on our fund looks set to rise from 3.9% over the past 12 months to 6.1% over the next 1213.

Share prices follow fundamentals

It shouldn’t be controversial to point out that share prices ultimately follow fundamentals, but in a momentum-driven market where a handful of stocks are attracting the lion’s share of inflows, investing in cheap growth stocks rather than expensive ones can make us feel like the odd ones out.

Investors often seek comfort in what has worked before. But this ignores that fact that even the most dominant businesses can quickly run into trouble.

As Greek philosopher Heraclitus of Ephesus once said: “The only constant in life is change.”

Just remember, even flares were popular once.

2Bloomberg (local currency, price only)

3https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb

4https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb

5https://www.forbes.com/1999/12/07/mu6.html?sh=5accbe82135e

6https://www.cnbc.com/2017/08/29/steve-jobs-and-bill-gates-what-happened-when-microsoft-saved-apple.html

7https://www.bbc.co.uk/news/technology-23947212

8https://www.bbc.co.uk/news/technology-23947212

9Bloomberg

10Source: Artemis/FactSet

11Source: Artemis/FactSet

12Source: Artemis/FactSet

13Source: Artemis/FactSet